Do Rig Counts Tell Us Everything We Need to Know? – Part 4

July 26, 2021 Article by Jeffrey PriceThe oil industry has a notorious reputation for booms and busts, and no two are alike. Obviously, the unprecedented collapse of drilling activity starting last March (’20) and ending in August was a chart-buster. However, the recovery that is currently underway displays its own unique facets. It is way slower than the rate of recovery in oil prices would imply. And, that’s affecting industrial leasing in Pecos, Texas in profound ways – but, there may be a long-term benefit from all this as reported in the article below from the Wall Street Journal of July 23, 2021:

Oil-field services companies have been in bunker mode for a while. They are finally starting to see some daylight.

After a cautious first quarter, industry giants Halliburton, Schlumberger and Baker Hughes all started chasing business more aggressively in the second quarter, with each seeing healthy sequential increases in revenue. It helps that they can now command better prices from producers able to haggle during downturns.

For several months already, oil prices have been well above pre-pandemic levels, but servicers’ revenues remain well below 2019 levels as producers opt to repair their balance sheets instead of chasing growth. Their bottom lines, however, are starting to show that their days spent scrimping and looking for efficiencies haven’t gone to waste.

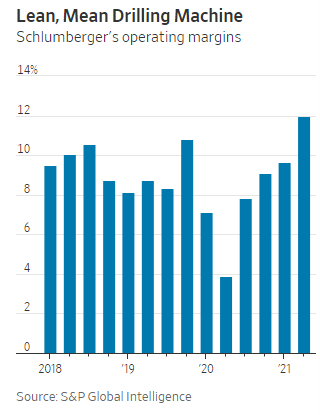

At Halliburton, revenue in the second quarter was less than two-thirds of what it was in the same period of 2019 but net income was three times as much. Operating margins at Schlumberger comfortably exceed pre-pandemic levels.

In another sign of progress, servicers’ free cash flows have started looking healthy enough that executives have begun fielding questions about when they might start returning excess cash.

Wall Street Journal

July 23, 2021

By Jinjoo Lee

The History of Permian Basin Oil

July 14, 2021 Article by Jeffrey Price

Today, the Permian Basin is the largest petroleum-producing basin in the United States- and only growing as First Keystone Pecos Industrial Park uses its infrastructure to make the best out of land in Pecos, TX. To shed light on why land in Pecos, TX and throughout the Delaware Basin section of the Permian is valuable for commercial property, it helps to explore the history of oil discovery in the region.

In the early 1900’s, during the initial boom of exploration in Texas, the arid and sparsely populated Permian Basin was not seen as an area ripe with opportunity. By the start 1920’s there was not one oil producing well within 100 miles of the Delaware Basin due to a lack of oil discovery and infrastructure- but this would soon change as Frank Pickrell and Haymon Krupp founded Texon Oil and Land Company. Pickrell hired a geologist to pinpoint a target for drilling that was miles away from the railroad where the equipment was to be delivered. Due to a tight time constraint for Pickrell’s lease, he had his men drill 124 feet from the station- miles away from where the geologist had selected initially.

Santa Rita #1 blew out on May 28, 1923 and produced between 100 to 150 barrels of oil per day. At the time, the well lacked pipelines, meaning that the oil needed to be transported by railroad. This was convenient for Santa Rita #1, however, as drilling had commenced very close to the nearby station. Developers built oil storage tanks nearby with a capacity of 80,000 barrels and eventually expanded to form a 400-mile pipeline to refineries on the coast. The success of Santa Rita #1 meant that more people were becoming interested in exploration and investment for reserves in the Permian Basin. During this time, drillers targeted conventional wells for oil production and technology paved the way for the development, discovery, and redevelopment in the region.

Frank Pickrell realized that he needed to drill additional wells as a condition of the terms of the State of Texas oil and gas leases he had acquired but quickly realized that he would need to secure more funding. Pickrell negotiated the sale of a portion of the leasehold interest and interest in the Santa Maria #1 to Michael Benedum and Joseph Trees. The pair created Big Lake Oil Company after the deal and agreed to handle development costs as well as drill at least eight wells.

Benedum had a few successes after the founding of Big Lake Oil Company, with his biggest coming after acquiring leases on Yates Ranch. In 1926, the Yates struck oil with a flow of 3,240 barrels per hour and, a year or so later, Yates #30-A had an initial production rate of a whopping 204,600 barrels per day- breaking a world record and proving the viability of the Permian Basin for commercial success. Soon after, major oil companies would venture into the Permian and further develop the area for production.

At First Keystone Pecos Industrial Park we recognize that the rich history of the Delaware Basin and larger Permian Basin plays an important role in why the land is considered a growing hub to this day. With the economic boom that has led to the U.S. becoming the world’s leading oil producer, there is an opportunity to expand your business and seize advantages made possible by expanding infrastructure through leasing or purchasing land in Pecos, TX.