When Will Activity Shift Into a Higher Gear?

January 13, 2022 Article by Jeffrey PriceAs previously reported, 2021 was a head-scratcher because of a tepid “ramp-up” during the year punctuated by strong oil prices and a booming economy. (Take a look at previous commentaries for more details.) As the new year dawns, there are promising signs that a genuine acceleration of activity is right around the corner.

Case (1) in point: Oil prices recently pierced through the $80/bbl level less than 6 weeks after hitting a low at a price point nearly ¼ lower – what a sign of resiliency!

That low point was caused by extreme fear in the marketplace over a repeat of the spring ’20 implosion that was anticipated at the inception of the Omicron variant. But, it is turning out that the world was able to adapt successfully.

Case (2) in point: NG prices in Europe on a BTU basis are equivalent of $200 per barrel of oil. Even though the European market appears to be de-coupled from the North American market, development of LNG port facilities is feverishly underway as a means to take advantage of this massive arbitrage condition.

Case (3) in point: Permitting for new wells, although erratic on a month-to-month basis, clearly is on the uptick. For example, permits for new wells in Reeves County in December was 65, a level 25% above the average of all of 2021. It is a leading indicator and it is 100% logical given that the very strong prices for oil show no sign of tanking. Indeed, there appears to be a long way to go in terms of a bounce-back of permits as the average numbers 4 years ago were far higher than they are now.

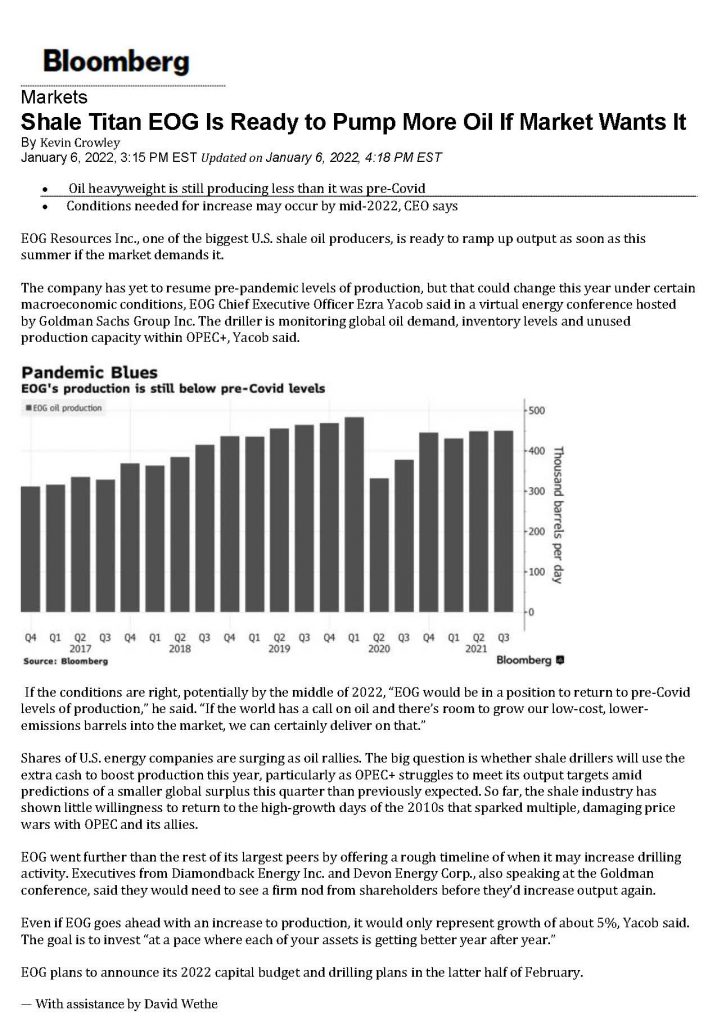

Case (4) in point: Finally, and perhaps most important, one of the US’ most significant independents, EOG Resources, has broken with the tacit “pact” among the shale producers and has declared that it is getting ready to ramp-up production to pre-pandemic levels.

EOG’s breakout move could turn out to be an inflection point for the US shale industry.

- Will most of the other shale players continue to adhere to the unwritten alliance with OPEC+?

- If that alliance disintegrates, how much will oil field activity pick up in order to get back to 13MM BBLs per day that existed immediately prior to the pandemic shut-down?

- Then, what happens to WTI/Brent – do they take a nosedive into the $50s or do they hold up?

For First Keystone Pecos Industrial Park, these are all harbingers of the importance of ramping up our inventory of industrial land in Pecos, TX available for warehouses, offices, and yards.