Is the Slump in the Stock Prices of Oilfield Service Companies Justified?

July 27, 2022 Article by Jeffrey PriceIn this space, we have chronicled the peculiarly slow ramp-up in drilling activity that has followed the dramatic resurgence in oil prices. We have also noted that this recovery clearly appears to be ushering in a period of sustained prosperity. In other words, we take the position that the industry is not in the midst of a quick bust-boom-bust cycle. That’s due to extremely strong fundamentals on both the demand-side and supply-side. That’s doubly true if you are situated in the Permian Basin.

And the Wall Street Journal in a recent report sees it the same way (https://www.wsj.com/articles/oil-doesnt-have-to-boom-for-these-companies-to-thrive-11658506682?st=i7hzwrnfrcz9sis&reflink=desktopwebshare_permalink). Thus, the stock market sell-off, that was prompted by the peaking out of WTI in early June, was clearly a serious overreaction. The industry’s fundamentals remain strong, and they will be resilient.

Many of the clients that have set up shop in the First Keystone Pecos Industrial Park also see it this way – they are taking the long view. And that’s why First Keystone is committed to developing Class A office and industrial space for sale in the Pecos area.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Do Rig Counts Tell Us Everything We Need to Know? – Part 6: Foundation Being Built

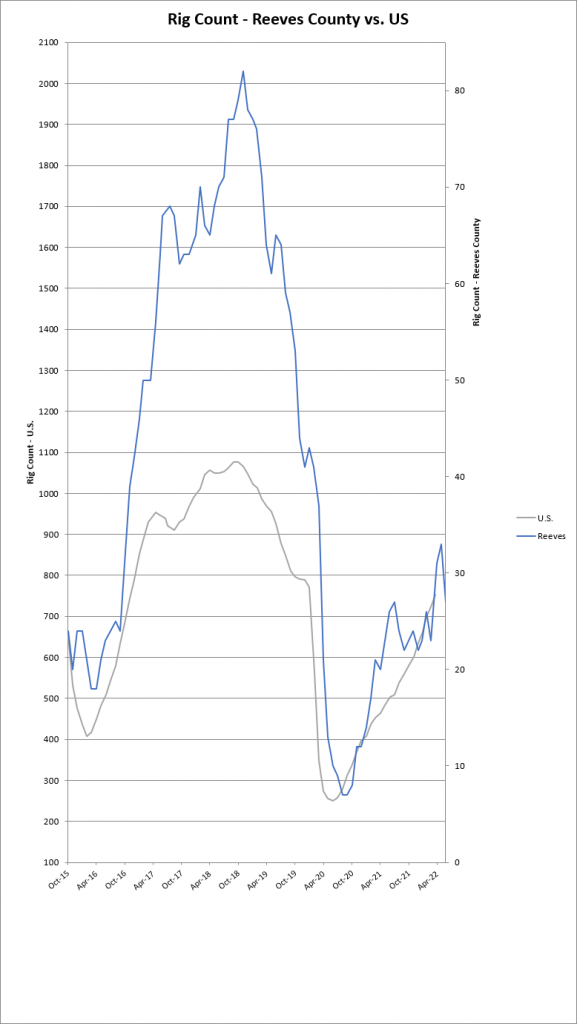

July 20, 2022 Article by Jeffrey PriceThe rig count zoomed up earlier this year to as much as 32 active rigs in June, but has clearly leveled off in the high 20s.

But the story is more interesting than a nice uptick. We are reading Wall Street reports that show the service industry – in the summer! – is already setting the groundwork for a ramp-up in the new year. With oil prices as stout as they have been for some time, this ramp-up that is coming sure took a long time to materialize, but it looks like there is going to be a long-lasting phase of growth in the U.S. oil & gas industry.

No wonder – take a look at our other recent posting (July 19, 2022) on the strategic importance of U.S. oil & gas.

First Keystone continues to support companies that enable the development of strategically important natural gas in Reeves County (Texas’ #1 for NG production) and the Delaware Basin by adding new infrastructure – such as industrial buildings for sale.

Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages

July 19, 2022 Article by Jeffrey PriceThe war in Ukraine has prompted a re-think by the Biden Administration towards fossil fuel extraction. President Biden even went to Saudi Arabia with hat-in-hand asking for increased production. There is lip service given to easing the red tape inhibiting a faster ramp-up in U.S.-based oil & gas production and transportation. In fact, if the U.S. is going to make a meaningful impact to offset the decline in supply from the USSR (oops! I meant to say “Russia”), then the path must be smoothed for the Permian and other important oil fields to ramp up production as well as midstream capacity to move the increased production to ports. That is strategically important!

Wait a minute! What about the transition to green energy!? Well, the respected Economist weighed in on the answer to that question with an excellent lead editorial on June 24, 2022. Here is a salient excerpt:

One priority is finding a way to ramp up fossil-fuel projects, especially relatively clean natural gas, that have an artificially truncated lifespan of 15-20 years so as to align them with the goal of dramatically cutting emissions by 2050. The trick is to get business to back schemes designed to be short-lived. One option is for governments and energy grids to offer guaranteed contracts over this period that provide an adequate return on the understanding that capacity will be shut down early. Another is to pledge eventual state support to make these projects cleaner, for example through carbon capture and storage.

These inducements, along with others, accomplish both aims – indeed, regardless of the war, there need to be mechanisms put in place to keep energy flowing while the green energy ramps up.

First Keystone continues to be part of the solution by building new infrastructure – such as industrial buildings for lease – that is supporting companies that enable the development of strategically important natural gas in Reeves County (Texas’ #1 for NG production).

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.