Crack in the Dike at OPEC

January 10, 2023 Article by Jeffrey PriceNo less an authority than Daniel Yergen has weighed in on the attempt by western democracies to force upon the Russians a bifurcated crude oil market. He did it via an Op-Ed piece in the Wall Street Journal published on December 26, 2022 (https://www.wsj.com/articles/putin-cant-count-on-the-global-oil-market-price-cap-revenue-production-cut-friedman-biden-eu-russia-energy-11672065849?reflink=desktopwebshare_permalink). It appears that the west has initially gained modest success in forcing the Russians to endure prices that are running roughly $15-$20 per barrel less than Brent Crude. This is not a massive discount, but it is an involuntary arrangement which is unprecedented price control. De facto it undermines OPEC’s power. Recently published statistics indicate the Russians have had to cut back production by roughly 2MM BOPD. This shift – thought to be dubious – is, at least initially, working.

What Yergen did not go into is the direction of the overall crude oil market in the next two or three years. That’s the more interesting issue because the fundamental signs are that new supplies are not being brought on fast enough to keep up with demand. That’s due in large part to lackluster CapEx plans across the U.S.-based shale producers; although Exxon is upgrading as it reports plans to increase output by 20% in the next few years. (Chevron has a similar story, too.) Demand, however, is The Wild Card because China’s abrupt reversal on Covid lockdowns is creating economic turmoil. The overriding issue for the near term is the degree to which the Chinese economy will slow down. And, no one can make a reliable prediction about that factor at this time. Offsetting possible softness from China is the struggle that the U.S. Government will face as it attempts to replenish the 180,000,000 barrels of crude that were utilized last year from the Strategic Petroleum Reserve.

Helping to ramp up U.S. production, we at First Keystone lodged in Pecos (Texas) continue to support the strengthening of the U.S.-based supplies of crude by offering state-of-the-art industrial buildings for lease in Pecos (Reeves County), TX. So, oil prices could be soft or they could soar! We’ll be monitoring these critical moving parts and keeping you informed as this new year plays out.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages – Another Expert’s Thoughts

December 28, 2022 Article by Jeffrey PriceThe legendary founder of Cheniere Energy, Inc., Charif Souki, has weighed in on US energy policies with a particular focus on our positioning in the international landscape. Mr. Souki was born and educated in the Middle East, but is a true American, and it would behoove us all to pay attention to what he has to say in the article below from the October issue of Oil and Gas Investor.

First Keystone continues to be part of the solution by building new infrastructure – such as industrial buildings for lease located in Pecos (TX). These companies enable the development of strategically important natural gas in Reeves County (Texas’ #1 county for NG production).

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages – Permian Basin Is a Global Strategic Asset

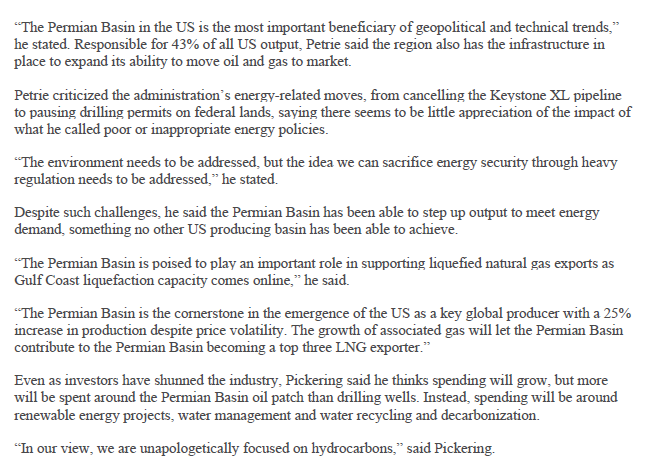

November 29, 2022 Article by Jeffrey PriceWe have shared our views about the importance of more aggressive development of oil & gas reserves as a critical component of a U.S. response to the escalating struggle between autocratic regimes and democracies. We have pointed out that there really is not a conflict between green energy and fossil fuels in the near term. And, Tom Friedman of the New York Times best articulated that position as we discussed in our blog post earlier this month . However, two highly respected investment analysts in the O&G industry, Dan Pickering and Tom Petrie, addressed a Hart Energy Conference in Midland last week underscoring just how critical the Permian Basin is to U.S. oil production, and more importantly, the U.S. has the ability to substantially ramp up its production of hydrocarbons as a means to soften the blow of foregone Russian O&G supplies.

We at First Keystone are 100% behind the policies that Petrie and Pickering are advocating, and thus, we continue to offer for lease industrial warehouses in Pecos, the hub of the Delaware Basin.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages – Revisited Again

November 2, 2022 Article by Jeffrey PriceThere’s a vicious war going on in Europe and it’s clear that Putin sees it as a struggle against the West in general and the U.S.A. in particular. The oil & gas industry needs to step up! First Keystone continues to be part of the solution by offering new industrial buildings for lease as our way of supporting critical companies that support oil & gas production and transportation in Reeves County (Texas’ #1 for NG production) to win the war against the USSR! (Oooops! Another slip!)

We have been sounding the alarm about the unwarranted perceived conflict between going green and developing fossil fuel resources more aggressively. No less an authority than Tom Friedman of the New York Times – many oil & gas people are dismissive of this publication, but shouldn’t be – weighs in on it. Those of you with preconceived notions will be very surprised when you read this article…

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages – Revisited

October 27, 2022 Article by Jeffrey PricePreviously, back in the summer, we griped about the lackluster response of mainstream O&G producers in terms of their efforts to ramp up domestic energy volumes (July 19 blog post). On October 24th, the conservative-leaning Wall Street Journal reported on this same topic (see article here) pointing out that the priorities of the companies are primarily directed at maximizing shareholder payouts and carping about federal regulations. What patriots these folks are! Those regulations they moan about have not radically constricted this industry since the Biden Administration took the reins. In fact, there are plenty of drillable well sites permitted and ready-to-go in the Permian Basin. It’s a cop-out excuse! Indeed, a cynic would wonder whether industry leaders are quietly working to undermine a laudable national strategic goal.

And, the next question is: Are shareholders served by this behavior? The WSJ article points out that industry leaders generally believe that prices are headed upwards, which would be a pretty positive factor in the equation about whether or not production ought to be ramped up. That certainly would have been the upshot a half-dozen years ago – and the fundamentals are way better nowadays.

What about ESG considerations? Well, let’s think about that for a moment. Should the United States be expanding fossil fuel production when supposedly it is leaning toward reducing greenhouse gas emissions. The answer to that dilemma h as to be considered in an overall environment where an existential war is being fought in Eastern Europe. And, if a powerful coalition is to be held together, then the US must step up big-time to help overcome the shortfalls resulting from embargos imposed on the USSR (oooops! I meant the Russian Empire). Where are our flag-waiving oil industry chieftans!?

First Keystone continues to be part of the solution by building state-of-the-art infrastructure – such as industrial buildings for lease – that is supporting companies that enable the development of oil & gas in Reeves County (Texas’ #1 for NG production).

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Does $70 Oil Make Sense???

October 6, 2022 Article by Jeffrey PriceMuch to our utter surprise, the price of oil dipped into the $70s in late September leaving us scratching our heads as to what are these energy traders thinking!? The precipitous decline in the price of oil as dramatically depicted in this graph doesn’t make any sense to those who follow global affairs.

Let’s take a look at some basic facts:

- OPEC+ has shown remarkable self-discipline by keeping its quotas tight. Thus, the raw fundamentals of supply and demand – real consumers and real producers – point towards a tightening market.

- Since March, the Biden Administration has been peeling off oil out of the Strategic Petroleum Reserve (SPR) for more than a half-year as a way to bolster domestic supply and, thus, tamp down domestic gasoline prices that were spiraling into a politically unacceptable level. It’s still going on. (We will leave until another day a commentary on the appropriateness of meddling with the SPR to deal with domestic inflation matters.)

- Despite record profits, most US-based oil companies have not appreciably increased their rig counts year-over-year. Some notables (Pioneer) are flat YoY.

- The embargo on Russian energy is working in terms of BOPDs not exported. (We’ll leave to another commentary the nuances of the silver lining that the Ruskies have been enjoying.) The US et.al. is not stepping-up-to-the-plate sufficiently to replace it. Moreover, transportation infrastructures have to undergo major modifications to facilitate new patterns of suppliers and consumers.

- $70 oil seems to discount the impacts of a purported worldwide recession. But, it is nowhere to be seen.

So, the price of oil has abruptly taken off early in October as have many sectors of commodity and financial markets – our question is this: What new news emerged in the last 3 business days that justifies a major rally in oil prices? Our view is that maybe those smarty-pants oil traders had time over the past weekend to review market fundamentals and have opted to reverse their bearish positions.

Indeed, the pendulum on prices could swing violently upward. Take a look at this New York Times article about that SPR. Among the many interesting points made in there, it raises the issue of what happens to the pricing of crude oil once the Biden Administration gets around to replenishing the SPR inventory. And, since then, OPEC+ announced an unexpected roll-back in quotas.

In sum, we at First Keystone view the fundamentals of producing and selling oil and natural gas as favorable in the short-term as well as fundamentally sound in the intermediate term. Certainly, the worldwide market for natural gas is undergoing radical changes. We are doing our bit to aid in that process by leasing industrial buildings in Pecos (TX) to serve the oil industry’s needs.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Important Immigration Policy Improvements Are Stalled

August 18, 2022 Article by Jeffrey PriceThe well-respected magazine, The Economist, in its July 30th issue weighed in on immigration, but not in a way that one might expect. Specifically, it had a lot to say about America’s need for more immigrants to address the widespread problem of unfilled jobs ranging from resort workers to high-tech engineers. Sadly, the magazine article points out that the never-ending crisis over how to manage the southern border blocks any advance movements toward a sensible reform of which and how many applicants can enter into the US. Much food for thought. (Note: Former president George W. Bush was the last Republican who took on this particular issue.)

You can read the article here: https://www.economist.com/united-states/2022/07/28/a-shortfall-in-immigration-has-become-an-economic-problem-for-america.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

What The Economist Has to Say About ESG

August 1, 2022 Article by Jeffrey PriceThis author often turns to The Economist as a source to cite when advocating a particular position. The much-over-used acronym, ESG, became the focus of one of its recent cover stories (https://www.economist.com/leaders/2022/07/21/esg-should-be-boiled-down-to-one-simple-measure-emissions). We read so often about “ESG this and ESG that” in the releases from publicly-traded energy companies, and The Economist points out that a lot of these factors ought to be severely de-emphasized. We agree. We do not take the exact opposite point of view, but we simply view matters of Social or Governance as secondary to the measurement of performance of a private enterprise. Let us repeat, they are relevant, but they are far from primary in importance.

Unfortunately, ESG has become too big of a factor in the guiding principles of some publicly-traded energy companies (Shell?) and consequently, this once-renowned oil company has latched on to looney ideas as to where it is going to re-deploy its gargantuan base of equity capital. Stated in a different way, this company no longer has a defensible business model.

Somewhat similar criticisms can be leveled at other publicly-traded energy companies, while those that are funded by more opaque private equity have stayed with a more narrow focus on a core principle of profit-making.

But! The Economist editorial points out that the “E” in ESG ought to stand for emissions, and the opinion writers strongly support the notion of many inducements to bring about a decrease in worldwide emissions of CO2 and other harmful gasses. That stance does not make The Economist editorial board as anti-oil, but simply means that the externalities (i.e., costs not borne by the corporation) associated with consumption of oil should be assessed back against those who chose to consume it.

We at First Keystone wholeheartedly support responsible use of hydrocarbons and we contribute to the objective by offering to lease Class A industrial facilities.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Is the Slump in the Stock Prices of Oilfield Service Companies Justified?

July 27, 2022 Article by Jeffrey PriceIn this space, we have chronicled the peculiarly slow ramp-up in drilling activity that has followed the dramatic resurgence in oil prices. We have also noted that this recovery clearly appears to be ushering in a period of sustained prosperity. In other words, we take the position that the industry is not in the midst of a quick bust-boom-bust cycle. That’s due to extremely strong fundamentals on both the demand-side and supply-side. That’s doubly true if you are situated in the Permian Basin.

And the Wall Street Journal in a recent report sees it the same way (https://www.wsj.com/articles/oil-doesnt-have-to-boom-for-these-companies-to-thrive-11658506682?st=i7hzwrnfrcz9sis&reflink=desktopwebshare_permalink). Thus, the stock market sell-off, that was prompted by the peaking out of WTI in early June, was clearly a serious overreaction. The industry’s fundamentals remain strong, and they will be resilient.

Many of the clients that have set up shop in the First Keystone Pecos Industrial Park also see it this way – they are taking the long view. And that’s why First Keystone is committed to developing Class A office and industrial space for sale in the Pecos area.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Do Rig Counts Tell Us Everything We Need to Know? – Part 6: Foundation Being Built

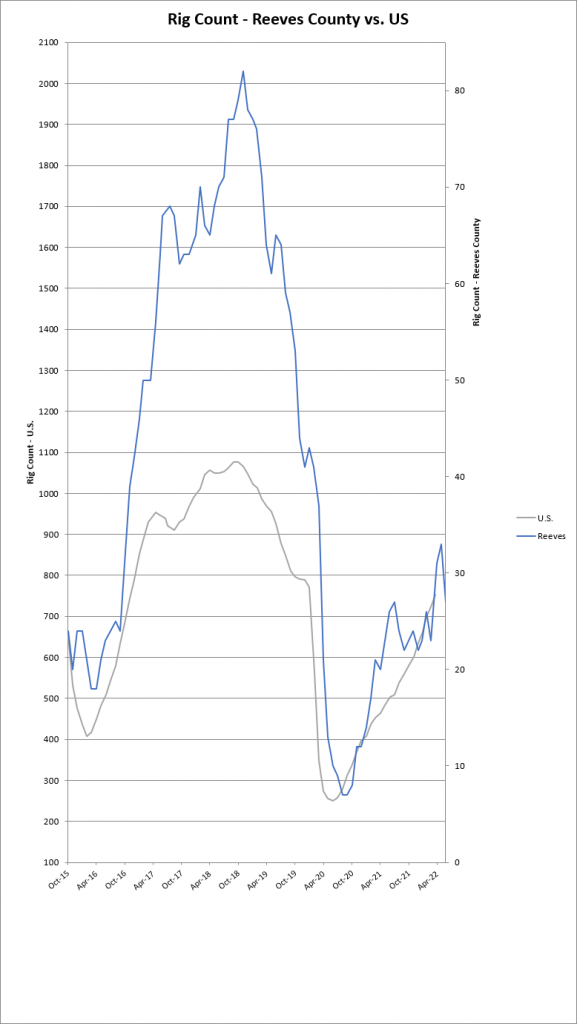

July 20, 2022 Article by Jeffrey PriceThe rig count zoomed up earlier this year to as much as 32 active rigs in June, but has clearly leveled off in the high 20s.

But the story is more interesting than a nice uptick. We are reading Wall Street reports that show the service industry – in the summer! – is already setting the groundwork for a ramp-up in the new year. With oil prices as stout as they have been for some time, this ramp-up that is coming sure took a long time to materialize, but it looks like there is going to be a long-lasting phase of growth in the U.S. oil & gas industry.

No wonder – take a look at our other recent posting (July 19, 2022) on the strategic importance of U.S. oil & gas.

First Keystone continues to support companies that enable the development of strategically important natural gas in Reeves County (Texas’ #1 for NG production) and the Delaware Basin by adding new infrastructure – such as industrial buildings for sale.