Managing the Conflict Between “Going Green” and Preventing Disastrous Energy Shortages

July 19, 2022 Article by Jeffrey PriceThe war in Ukraine has prompted a re-think by the Biden Administration towards fossil fuel extraction. President Biden even went to Saudi Arabia with hat-in-hand asking for increased production. There is lip service given to easing the red tape inhibiting a faster ramp-up in U.S.-based oil & gas production and transportation. In fact, if the U.S. is going to make a meaningful impact to offset the decline in supply from the USSR (oops! I meant to say “Russia”), then the path must be smoothed for the Permian and other important oil fields to ramp up production as well as midstream capacity to move the increased production to ports. That is strategically important!

Wait a minute! What about the transition to green energy!? Well, the respected Economist weighed in on the answer to that question with an excellent lead editorial on June 24, 2022. Here is a salient excerpt:

One priority is finding a way to ramp up fossil-fuel projects, especially relatively clean natural gas, that have an artificially truncated lifespan of 15-20 years so as to align them with the goal of dramatically cutting emissions by 2050. The trick is to get business to back schemes designed to be short-lived. One option is for governments and energy grids to offer guaranteed contracts over this period that provide an adequate return on the understanding that capacity will be shut down early. Another is to pledge eventual state support to make these projects cleaner, for example through carbon capture and storage.

These inducements, along with others, accomplish both aims – indeed, regardless of the war, there need to be mechanisms put in place to keep energy flowing while the green energy ramps up.

First Keystone continues to be part of the solution by building new infrastructure – such as industrial buildings for lease – that is supporting companies that enable the development of strategically important natural gas in Reeves County (Texas’ #1 for NG production).

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Feasible Plans to Convert to a Decarbonized Economy

June 1, 2022 Article by Jeffrey PriceWe read with great interest a book review in the Wall Street Journal the other day – its title was “How the World Really Works” by Vaclav Smil. The author is a polymath who has competencies across many, many diverse, but interconnected fields. Check it out (https://www.wsj.com/articles/how-the-world-really-works-book-review-putting-it-all-together-11651848551?st=iq7nlpt21rqcjv3&reflink=desktopwebshare_permalink).

because what we found most illuminating was his point that the math simply doesn’t work to rapidly cut over to a renewable energy infrastructure for the entire American (or world) economy. He points out that the sources of the electric and the transmission infrastructure are not even close to being adequate to enable anything resembling a rapid phase-out of fossil fuels. He ridicules hard dates (e.g., 2050) for targets if the massive funding for new infrastructure isn’t also in place. He points out that the poorer countries can’t even consider these notions! It is just another example, from a qualified party, to introduce Green New Deal acolytes to harsh reality.

First Keystone is all in favor of green initiatives – and taking them fast. But our sober-minded approach to national energy policy is to provide infrastructure, such as warehouses for rent in Pecos (TX), the epicenter of the Delaware Basin, recognizing that this infrastructure is needed to generate much-needed natural gas that is a critical transition fuel.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Transitions to Green Aren’t As Easy As Saying It!

May 25, 2022 Article by Jeffrey PriceAs the ongoing nature of the Ukrainian war has become more painfully apparent, energy pundits of all stripes have evidenced varying degrees of awareness that there needs to be a transition in the U.S. policies on domestic production and exportation of fossil fuels. The key word in the previous sentence is “degrees” since unabashed fans of the O&G industry – primarily from the right end of the political spectrum – did not need the war to reach that conclusion. While shifts within the left have been far more interesting to watch play out. Sadly, the knee-jerk reaction of the Green New Deal types cannot be self-suppressed. And, the folly of their opinions is painfully obvious to anyone who has passed third grade arithmetic. But, when one can read a level-headed editorial from the highly-respected Thomas Friedman of the left-leaning New York Times who points out…

Let’s look at both. For too long, too many in the green movement have treated the necessary and urgent shift we need to make from fossil fuels to renewable energy as though it were like flipping a switch — just get off oil, get off gasoline, get off coal and get off nuclear — and do it NOW, without having put in place the kind of transition mechanisms, clean energy sources and market incentives required to make such a massive shift in our energy system.

It’s Germany in 2011, suddenly deciding after the Fukushima accident to phase out its 17 relatively clean and reliable nuclear reactors, which provided some 25 percent of the country’s electricity. This, even though Germany had nowhere near enough solar, wind, geothermal or hydro to replace that nuclear power. So now it’s burning more coal and gas.

A 2019 working paper for the U.S. National Bureau of Economic Research found that in Germany “the lost nuclear electricity production due to the phaseout was replaced primarily by coal-fired production and net electricity imports…

…then one can see there has been a genuine progression! And a for country that seems to have a hard time generating bi-partisan coalitions on anything, the left plus the right just might “get it” on this one! The Friedman editorial is not a sea change, but for a pundit with a huge following, his editorial is not insignificant. (https://www.nytimes.com/2022/05/17/opinion/russian-oil-green-energy.html)

And, First Keystone’s leadership, which often agrees with Thomas Friedman, is also doing its part by offering warehouses for lease in Pecos (TX) to serve the growing needs of the oil & gas industry.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Biden Administration Focused on Increased U.S. Oil & Gas Production

March 30, 2022 Article by Jeffrey PriceEver since the transition from the Trump Administration to the Biden Administration, rank-and-file leaders of the US O&G industry have been outspoken in expressing frustration with the Biden Administration declaring it as being “anti” fossil fuel. Sometimes, actual anecdotal examples surface some of which hold water. More often, the criticisms border on irrational hysteria with no concrete complaints. Many seem to forget that The Great Shale Revolution flourished under the aegis of the Obama Administration. In fact, Biden has done very little to impede[1] upward activity of the oil & gas industry. If impedances include tight restrictions on methane emissions, then – as long as those regulations are sensible – that would be a good thing.

Today, in the heat of a new Cold War, the criticisms leveled at the Biden Administration are crumbling as it laser-focuses on combatting the Russian menace. Level-headed advisors have finally gotten Biden’s ear and successfully pointed out that the U.S. has ascended into a global powerhouse as a producer of oil & gas. And, the Administration realizes that it has the capability to upgrade U.S. capacity, and thereby offset ultra-sensitive dependencies on Russian-supplied oil that exists in select European countries (e.g., Italy and Germany). Respected energy prognosticator, Daniel Yergen, weighed in with an excellent opinion piece published by the Wall Street Journal (before the Ukraine war broke out) – click here to read. Yergen points out that the U.S. has shifted the power dynamic away from OPEC (e.g., Iran and Saudi Arabia) and even Russia by being able to supply LNG in vast quantities to Northern Europe.

Let’s hope the pronouncements coming from the Biden Administration (e.g., Secretary of Interior Granholm) are not undercut by frivolous regulations that slow down the progression of a strategic ramp-up in US O&G production. What’s an example of “frivolous”, you say? How about silly attempts to prohibit cooking stoves using natural gas? Another example that might be truly important? That would be the federal judge instructing the federal government to take into account the carbon footprint associated with oil & gas produced from a federal lease. Do you know what that means? It means that the U.S. has decided that it will buy oil from foreign sources that aren’t dumb enough to self-impose UNILATERALLY a carbon penalty on its own production. The rational solution would be to apply a carbon tax across all oil consumed in the United States regardless of where it comes from. Why shackle U.S. producers?

First Keystone is taking steps right now to aid the increase in U.S.-based O&G production by accelerating our construction program to make available for lease a 5,000 s.f. office/warehouse located in Pecos.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

[1] It is a fact that the number of leases offered by the Biden Administration are comparable to those offered by the Trump Administration under comparable time periods.

Independents Leading the Charge to Surge U.S. O&G Production!

Article by Jeffrey PricePlease check out this brief, but very interesting, video report from the Washington Post covering the actions of our good friend in Oklahoma City, Joe Brevetti (founder of Charter Oak Production). In a nutshell, this small – but feisty – independent is punching way above its weight in making a difference in terms of America’s effort to bolster O&G production – this is a patriotic move (and, you don’t hear any moaning about impedances from the Biden Administration).

First Keystone supports the needed increase in US-based O&G production, and accordingly, we are fast-forwarding our program to develop more warehouses for lease in Pecos.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

The Resolve of the Allies and the United States to Impose a Total Embargo on Russian Energy

March 18, 2022 Article by Jeffrey PriceThis topic has gone from 0 to 60 in a record amount of time! Major publications are awash with articles on which country is willing to do what. The Wall Street Journal has gone out of its way to fire off round after round of criticisms aimed directly at the Biden Administration. In my opinion, some of them have merit and others come out of the same playbook used by those Philadelphians who threw snowballs at Santa during an Eagles game (40 years ago). A much more dispassionate treatise on this subject came from Max Fisher of the New York Times in his excellent piece, “Russia’s Other Contest with the West: Economic Endurance”. Please, take a few minutes to read it as it is about as good a rendition of forces on each and every party with respect to this very tough matter. (https://www.nytimes.com/2022/03/09/world/europe/russia-ukraine-economy.html) For the average American, it simply translates into some pain at the gas station. It is far different for a middle class family living in Germany or Italy. And the offset is that the average Russian citizen, many of whom barely grasp what’s going on in Ukraine thanks to Russia’s powerful disinformation campaigns, are utterly bewildered by the implosion of their own economy. The article has an excellent section near the end that delves into the potential collapse of support for Putin that has traditionally come from “Russian political elites…[who prize his] stabilizing the country and winning it respect abroad”. Many also expressed concern over his handling of the economy – an opposition to military adventurism in Ukraine.

I mentioned the Wall Street Journal, and I should not have omitted Fox News, but some of the claims leveled at Biden, such as complaining about the cancellation of the Keystone XL pipeline, are spurious if they are meant to explain why gas prices are so high. This link is a FACT-CHECK piece by Linda Qui writing for the New York Times. (https://www.nytimes.com/2022/03/09/us/politics/fact-check-republicans-biden-gas.html)

Lastly, under the heading of macabre comedy, is this editorial from the March 8th Wall Street Journal where the editorial board unrelentingly lambastes Biden for cozying up to such nice folks as Maduro (Venezuela) or MBS (Saudi Arabia). Finally in the last few words of the barrage of criticism, they point out that “shale producers can increase production twice as fast…” – well, let’s get on with it! (https://www.wsj.com/articles/joe-bidens-u-s-oil-embargo-russia-energy-natural-gas-vladimir-putin-ukraine-11646780609)

Right now, to support the needed increase in US-based O&G production, First Keystone is fast-forwarding our program to have ready-for-delivery warehouses for lease.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

What is the Appropriate Role for the U.S. O&G Industry in the Response to the Russian Invasion?

March 11, 2022 Article by Jeffrey PriceVery little was written about this subject until most folks went to their local gas station and experienced a big surprise. The “Big Picture” is that our gasoline prices are driven by global forces and it is virtually impossible to insulate an American consumer from these forces without a massive federal subsidy to support a lower gasoline price. These concepts are used in countries such as Egypt, India, Venezuela, and Saudi Arabia for gasoline. And, it places a tremendous stress on the public treasury. European countries are considering subsidizing natural gas prices right now. In my opinion, that would be a really bad idea in this country. In fact, open discussion about eliminating the federal tax on gasoline is moving in exactly the wrong direction – Americans can and should pay more to improve their roads via this tax! To learn a little more about the interplay of these forces, take a look at this article https://www.cnn.com/2022/03/10/politics/record-gas-prices-wont-be-solved-by-drilling-more-oil-climate/index.html.

A sober viewpoint comes from Bret Stephens of the New York Times advocates… “Be honest about energy. The world will need carbon-based fuels for decades to come. And we are better off extracting more of it in North America — including on U.S. federal land — than by asking Saudi Arabia to ramp up production or hoping to get more from Venezuela and Iran with sanctions relief. The alternative to increasing domestic oil and gas production isn’t only clean alternative energy. It’s also filthy petrostate energy.”

But, will the O&G industry actually respond and ramp-up production? As reported last week, the industry seemed to greet this crisis with a big yawn as senior management genuflected in the direction of Wall Street. So, is Wall Street to blame for this unpatriotic and counterproductive stance? It’s impossible to not hear blame directed at the Biden Administration. Well, the CNN article points out that criticizing the Biden Administration for insufficient permits is factually inaccurate. But, its report also points out that the Administration really ought to cut through the red tape in order to to speed up construction of new LNG terminals.

One of the better summarizations of the debate of who is to blame – Wall Street or the federal government? – was provided by CNBC’s Stephen Liesman – check out this clip from Morning Joe (https://www.msnbc.com/morning-joe/watch/-they-want-to-be-on-the-right-side-of-history-inside-the-white-house-s-ban-on-russian-oil-134962245593) to get his understandable explanation on who should do what. (Spoiler alert: They each need to do something!)

First Keystone is taking steps right now to aid the increase in U.S.-based O&G production by accelerating our plans to make available for lease warehouses by adding a 5,000 s.f. version of our Bobcat line of products.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

The Permian Basin Community’s Response to the Russian Invasion of Ukraine

March 4, 2022 Article by Jeffrey PriceI do not know what to believe. Here is a link to the New York Times article (3/3/22) in the Business section (https://www.nytimes.com/…/02/business/oil-prices-opec.html). It’s pretty good, and it points out that OPEC Plus has turned a blind eye toward the conflict. (After all, the Vice Chair of this organization is a Russian minister. I guess OPEC Plus is a formal organization???) It is obvious to any American citizen who shares this writer’s concern for the citizens of the Ukraine, that a component of the American response ought to be to ramp up crude oil production in all possible ways. From my perspective, I was appalled at the indifferent remark made by Vicki Hollub (CEO OXY) who did not seem to care nor have the breadth of knowledge to grasp that her company is strategic who told analysts that there was “no need and no intent to invest in production growth”. I don’t want to single her out for criticism because there are others: Pioneer, Devon, and Continental, which the article states “were committed to limiting production to avoid oversupplying the market and pushing down prices to unprofitable levels”. Some people have called me gullible. (That was about 50 years ago.) This report, if accurate, is unbelievable – these stances are an outrage. It’s not collaborating with the enemy, but it is darned close. But does this tell the whole story? Maybe not. A friend of mine shared with me conversations he’s had with his friends in Midland who are working with privately-owned producers, and “the buzz” is that they are ramping up. By the way, what capitalist would not ramp up right now!? (God help those shareholders who still own shares in these publicly-traded companies.) But, from an overall American point of view, any patriot who is opposed to the totalitarian brutality going on in Russia/Ukraine would make these moves. I hope that these entrepreneurial oilmen (and ladies) represent the mainstream of thinking in the Permian Basin community. In my view, this would be the quintessential response from a strategic American industry! First Keystone, although not a producer, is doing our part by ramping up our own production to provide industrial buildings for sale in the Delaware Basin.

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

Daniel Yergen Lauds U.S. Energy Resurgence

February 17, 2022 Article by Jeffrey PriceRespected oil prognosticator, Daniel Yergen, weighed in on February 15, 2022 with an opinion piece published by the Wall Street Journal on the U.S.’ ascendancy into a global O&G powerhouse. Yergen points out that power has shifted toward the U.S. in some ways due to the U.S.’ achievement of much more self-sufficiency in energy than was the case prior to the shale revolution. In particular, having grown into being the #1 producer of crude oil in the world, the U.S. is no longer as sensitive to the vagaries of odious regimes that control large reserves of oil (think Iran). Yergen lauds this emergence of the US-based oil industry and emphasizes that it has translated into a strengthened American ability to significantly diminish the leverage that is being exerted by Russia today in its powerplay to force Western Europe to helplessly stand by and watch the Russians annex Ukraine.

It is an article well worth reviewing.

If you are ready to locate to the heart of the Delaware, First Keystone has warehouses to lease in Pecos!

The opinions expressed above reflect only those of the author and do not represent those of the First Keystone Pecos Industrial Park organization. First Keystone welcomes responsible fact-based discourses on these topics.

When Will Activity Shift Into a Higher Gear?

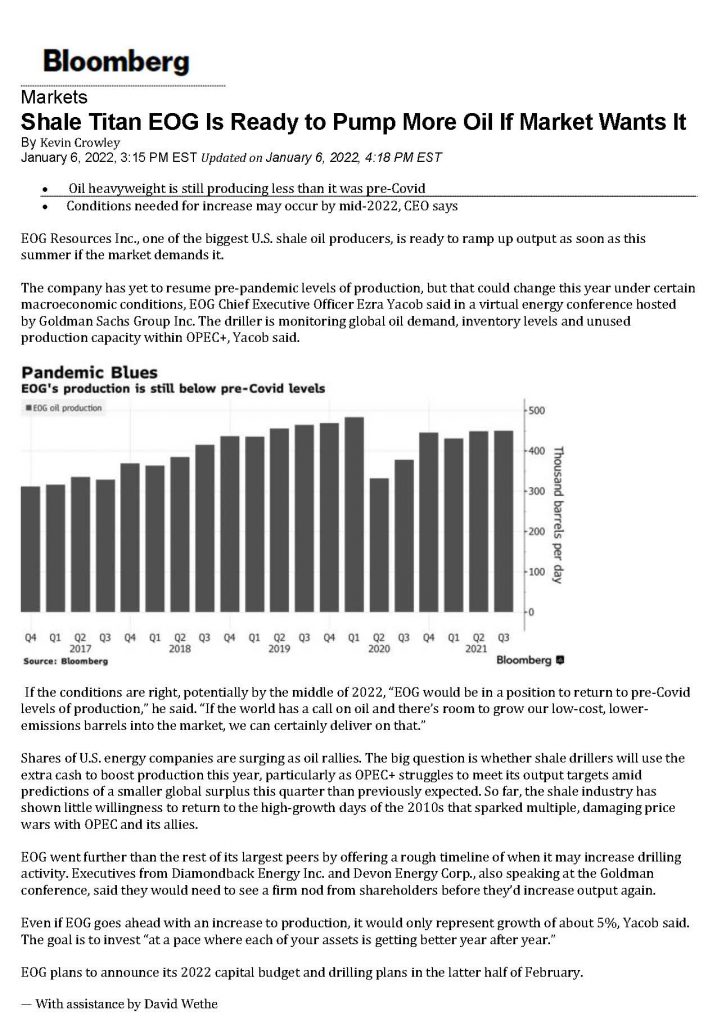

January 13, 2022 Article by Jeffrey PriceAs previously reported, 2021 was a head-scratcher because of a tepid “ramp-up” during the year punctuated by strong oil prices and a booming economy. (Take a look at previous commentaries for more details.) As the new year dawns, there are promising signs that a genuine acceleration of activity is right around the corner.

Case (1) in point: Oil prices recently pierced through the $80/bbl level less than 6 weeks after hitting a low at a price point nearly ¼ lower – what a sign of resiliency!

That low point was caused by extreme fear in the marketplace over a repeat of the spring ’20 implosion that was anticipated at the inception of the Omicron variant. But, it is turning out that the world was able to adapt successfully.

Case (2) in point: NG prices in Europe on a BTU basis are equivalent of $200 per barrel of oil. Even though the European market appears to be de-coupled from the North American market, development of LNG port facilities is feverishly underway as a means to take advantage of this massive arbitrage condition.

Case (3) in point: Permitting for new wells, although erratic on a month-to-month basis, clearly is on the uptick. For example, permits for new wells in Reeves County in December was 65, a level 25% above the average of all of 2021. It is a leading indicator and it is 100% logical given that the very strong prices for oil show no sign of tanking. Indeed, there appears to be a long way to go in terms of a bounce-back of permits as the average numbers 4 years ago were far higher than they are now.

Case (4) in point: Finally, and perhaps most important, one of the US’ most significant independents, EOG Resources, has broken with the tacit “pact” among the shale producers and has declared that it is getting ready to ramp-up production to pre-pandemic levels.

EOG’s breakout move could turn out to be an inflection point for the US shale industry.

- Will most of the other shale players continue to adhere to the unwritten alliance with OPEC+?

- If that alliance disintegrates, how much will oil field activity pick up in order to get back to 13MM BBLs per day that existed immediately prior to the pandemic shut-down?

- Then, what happens to WTI/Brent – do they take a nosedive into the $50s or do they hold up?

For First Keystone Pecos Industrial Park, these are all harbingers of the importance of ramping up our inventory of industrial land in Pecos, TX available for warehouses, offices, and yards.