Responsible Transitioning from Fossil Fuels – Part 2

November 29, 2021 Article by Jeffrey PriceRecently, we talked about the importance of having a PLAN to execute a phase-out of legacy sources of energy (i.e., fossil fuels) and replacing these sources with “renewables”. In that report, we cited an editorial from The Economist published in October. Another authoritative, albeit biased, source would also be worth listening to as it has equally responsible opinions to be shared. The editorial excerpted below is from Steve Toon, the Editor in Chief of Oil & Gas Investor, points out that the new criteria for measuring performance of oil & gas companies have shifted away from surviving the recent recession to something he called “value versus momentum”. I’m not sure what he’s even talking about, but he does point out – very importantly – that capital has been choked off into the oil & gas sector, and the net effect is that capacity (i.e., daily production) is dissipating. He explains that super-majors, especially European based companies like Equinor and Shell, are actually disinvesting in shale assets. He points out that the amount of capital being deployed into the sector is so low that required daily production volumes, needed for the next decade, are destined to fall short.

Just like The Economist warned in that October editorial, short squeezes are going to emerge because the transition plan to some sort of other energies is far from ready for prime time. So, from a policy point-of-view or an investor’s viewpoint, one’s focus ought to shift back to the Permian Basin’s plentiful oil & gas reserves.

First Keystone has industrial buildings ready-to-go for sale or lease in Pecos (the heart of the western Permian Basin) to serve those service & supply companies that will be crucial if these short squeezes are going to be abated.

Responsible Transitioning from Fossil Fuels

November 23, 2021 Article by Jeffrey PriceWe at First Keystone are supportive of taking steps towards a greener economy in West Texas, the U.S., and the world. With the exception of a few mega-economies, such as the U.S. or China, no one state or company can accomplish much more than a spoonful in a bucket, but that limitation should not function as an excuse for doing nothing. And, we at First Keystone are going to do what we can to contribute to that goal. It may sound trivial, but our latest line of industrial buildings to rent or buy come equipped with 220V external receptacles to enable the set-up of EV charging stations.

But, what’s the point I’m making right now? It’s this: There are no magic bullets, and a transition to a significantly greener approach to energy generation is not going to occur without a full-blown plan that works at the local level, national level, and worldwide.

In this installment, we would like to share with you the thoughts of the Editorial Board at the esteemed magazine, The Economist (October 16, 2021 issue). As is the norm with this level-headed publication, they caution the world that severe shortages of critical forms of energy are right around the corner. And when they emerge, significant economic and even health repercussions are going to emerge. They caution that politicians waving their magic wands and declaring goals of 50% renewables by 2030 or whatever cannot be achieved without a transition plan. And, prematurely forcing a detachment from legacy systems – that involve hydrocarbons – will backfire without a concomitant replacement with comparable levels of alternative energies.

We will not comment on the replacement schemes, but we will point out that hydrocarbons are absolutely here for decades to come until the many, many trillions of dollars necessary to change out energy infrastructure have been properly deployed.

So, check out this editorial from The Economist and let us know your thoughts! But while pondering all of this, remember that First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region! Our industrial buildings (to rent or for sale) are state-of-the-art energy efficient and we aim to keep America energy independent. We are Part of The Solution!

Do Rig Counts Tell Us Everything We Need to Know? – Part 5

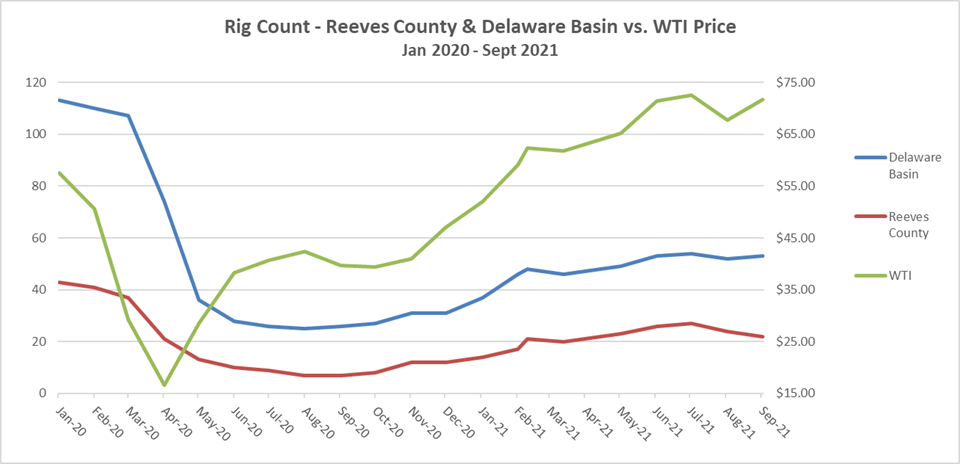

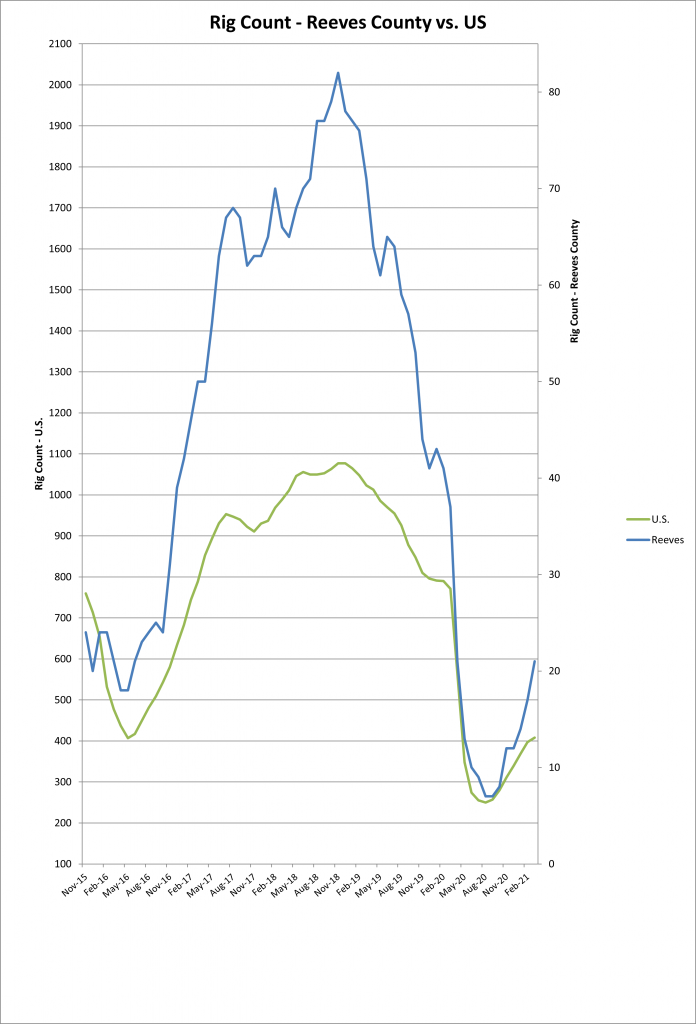

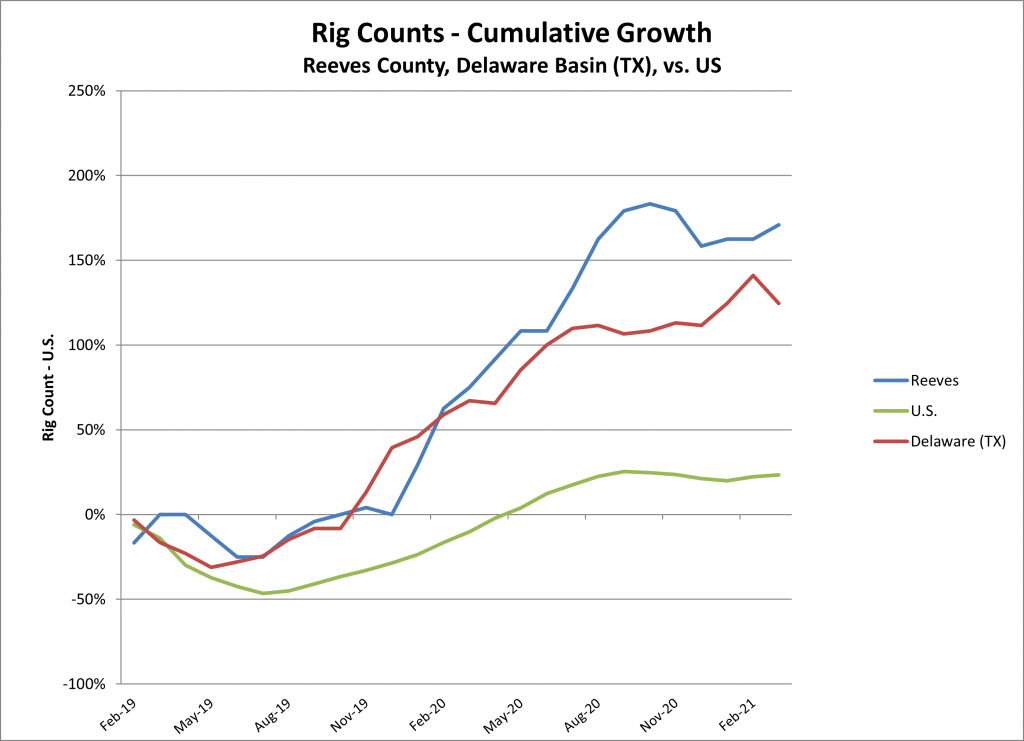

October 12, 2021 Article by Jeffrey PriceOil industry business cycles are unavoidable – but, no two are alike. However, this recovery, way slower than the rate of recovery in oil prices, has stalled. Look at this graph of rig counts for Reeves County and the Delaware since early ’20. Compared to all other recoveries, when the price of oil rebounds as sharply as indicated in this graph, the drilling rig counts would also zoom up. This is an outlier situation.

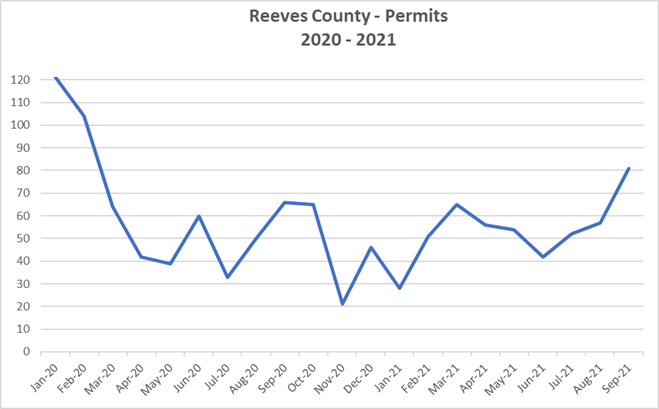

But drilling permits are starting to (finally!) show real signs of a recovery. This is the first genuine signal that the operators are responding to oil prices that are irresistibly high!

The bottom line is that permits are an irrefutable leading indicator of operating activity. The ramp-up may be just around the corner. However, the stock of small and medium-sized industrial/warehouse buildings (under 10,000 sf) in Pecos is very limited; but First Keystone has them to rent or for sale. Act now to avoid the coming bottleneck!

The “I” Word

October 7, 2021 Article by Jeffrey PriceAs we last reported, this “recovery… …displays its own unique facets. It is way slower than the rate of recovery in oil prices would imply”. The downside of this slow uptick is now rearing its ugly head – INFLATION! Yeow! The “I” word!

Well, it is inevitable: If the supply side cannot ramp up – for reasons due to Covid, labor shortages, scarce capital, too much risk, logistics or whatever – then, as the operators finally react to the very favorable price points for crude oil, the supply side is unable to ramp up in response to an upsurge in drilling and completions. That’s happening in many places. Take Oklahoma’s Anadarko Basin, for example. It got hit really hard with The Pandemic Recession – much harder than the Permian. The supply side was idled and skilled workers scattered. The core of the labor force was gutted. Now that operators – big and small – are trying to drill new wells for exploratory or developmental reasons, the service industry isn’t there to deliver. Shortages, lead times, work quality, and price quotes – all bad.

First Keystone saw this coming and we are trying to be part of the solution! We’re getting ready to deliver our first industrial building for lease in Pecos in two years! It is our entry-level Bobcat product which is a 3,750 sf office/warehouse with a one-acre fenced lot. This industrial building for lease is available now. Those suppliers looking to be able to respond should act now on this opportunity to rent an industrial building.

Do Rig Counts Tell Us Everything We Need to Know? – Part 4

July 26, 2021 Article by Jeffrey PriceThe oil industry has a notorious reputation for booms and busts, and no two are alike. Obviously, the unprecedented collapse of drilling activity starting last March (’20) and ending in August was a chart-buster. However, the recovery that is currently underway displays its own unique facets. It is way slower than the rate of recovery in oil prices would imply. And, that’s affecting industrial leasing in Pecos, Texas in profound ways – but, there may be a long-term benefit from all this as reported in the article below from the Wall Street Journal of July 23, 2021:

Oil-field services companies have been in bunker mode for a while. They are finally starting to see some daylight.

After a cautious first quarter, industry giants Halliburton, Schlumberger and Baker Hughes all started chasing business more aggressively in the second quarter, with each seeing healthy sequential increases in revenue. It helps that they can now command better prices from producers able to haggle during downturns.

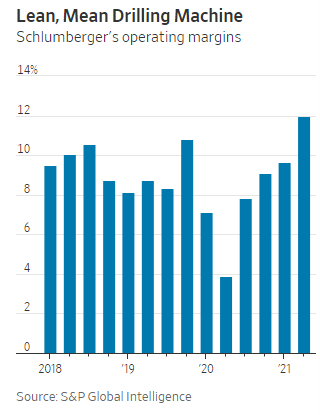

For several months already, oil prices have been well above pre-pandemic levels, but servicers’ revenues remain well below 2019 levels as producers opt to repair their balance sheets instead of chasing growth. Their bottom lines, however, are starting to show that their days spent scrimping and looking for efficiencies haven’t gone to waste.

At Halliburton, revenue in the second quarter was less than two-thirds of what it was in the same period of 2019 but net income was three times as much. Operating margins at Schlumberger comfortably exceed pre-pandemic levels.

In another sign of progress, servicers’ free cash flows have started looking healthy enough that executives have begun fielding questions about when they might start returning excess cash.

Wall Street Journal

July 23, 2021

By Jinjoo Lee

The History of Permian Basin Oil

July 14, 2021 Article by Jeffrey Price

Today, the Permian Basin is the largest petroleum-producing basin in the United States- and only growing as First Keystone Pecos Industrial Park uses its infrastructure to make the best out of land in Pecos, TX. To shed light on why land in Pecos, TX and throughout the Delaware Basin section of the Permian is valuable for commercial property, it helps to explore the history of oil discovery in the region.

In the early 1900’s, during the initial boom of exploration in Texas, the arid and sparsely populated Permian Basin was not seen as an area ripe with opportunity. By the start 1920’s there was not one oil producing well within 100 miles of the Delaware Basin due to a lack of oil discovery and infrastructure- but this would soon change as Frank Pickrell and Haymon Krupp founded Texon Oil and Land Company. Pickrell hired a geologist to pinpoint a target for drilling that was miles away from the railroad where the equipment was to be delivered. Due to a tight time constraint for Pickrell’s lease, he had his men drill 124 feet from the station- miles away from where the geologist had selected initially.

Santa Rita #1 blew out on May 28, 1923 and produced between 100 to 150 barrels of oil per day. At the time, the well lacked pipelines, meaning that the oil needed to be transported by railroad. This was convenient for Santa Rita #1, however, as drilling had commenced very close to the nearby station. Developers built oil storage tanks nearby with a capacity of 80,000 barrels and eventually expanded to form a 400-mile pipeline to refineries on the coast. The success of Santa Rita #1 meant that more people were becoming interested in exploration and investment for reserves in the Permian Basin. During this time, drillers targeted conventional wells for oil production and technology paved the way for the development, discovery, and redevelopment in the region.

Frank Pickrell realized that he needed to drill additional wells as a condition of the terms of the State of Texas oil and gas leases he had acquired but quickly realized that he would need to secure more funding. Pickrell negotiated the sale of a portion of the leasehold interest and interest in the Santa Maria #1 to Michael Benedum and Joseph Trees. The pair created Big Lake Oil Company after the deal and agreed to handle development costs as well as drill at least eight wells.

Benedum had a few successes after the founding of Big Lake Oil Company, with his biggest coming after acquiring leases on Yates Ranch. In 1926, the Yates struck oil with a flow of 3,240 barrels per hour and, a year or so later, Yates #30-A had an initial production rate of a whopping 204,600 barrels per day- breaking a world record and proving the viability of the Permian Basin for commercial success. Soon after, major oil companies would venture into the Permian and further develop the area for production.

At First Keystone Pecos Industrial Park we recognize that the rich history of the Delaware Basin and larger Permian Basin plays an important role in why the land is considered a growing hub to this day. With the economic boom that has led to the U.S. becoming the world’s leading oil producer, there is an opportunity to expand your business and seize advantages made possible by expanding infrastructure through leasing or purchasing land in Pecos, TX.

Rig Counts Lagging Dramatic Recovery in WTI!

May 20, 2021 Article by Jeffrey PriceRig counts bounced back from last August’s lows as oil prices dramatically rebounded into the $60s by early this year. That surge is attributed to optimism about an early wind-down of the pandemic-driven contractions. However, there was another major factor and that was “the markets’ approval” of unexpected discipline on the parts of both OPEC+, and more surprisingly, the US shale industry centered here in the Permian. “Discipline” is this informal alliance’s “Wink! Wink!” cooperation in the curtailment of daily production volumes. In essence, supply and demand have been brought into a stable balance due to a tacit (unwritten) agreement among the oddest aggregation of comrades that one can conjure up – MBS + Iranians + Putin + Permian “Shale Boys”!

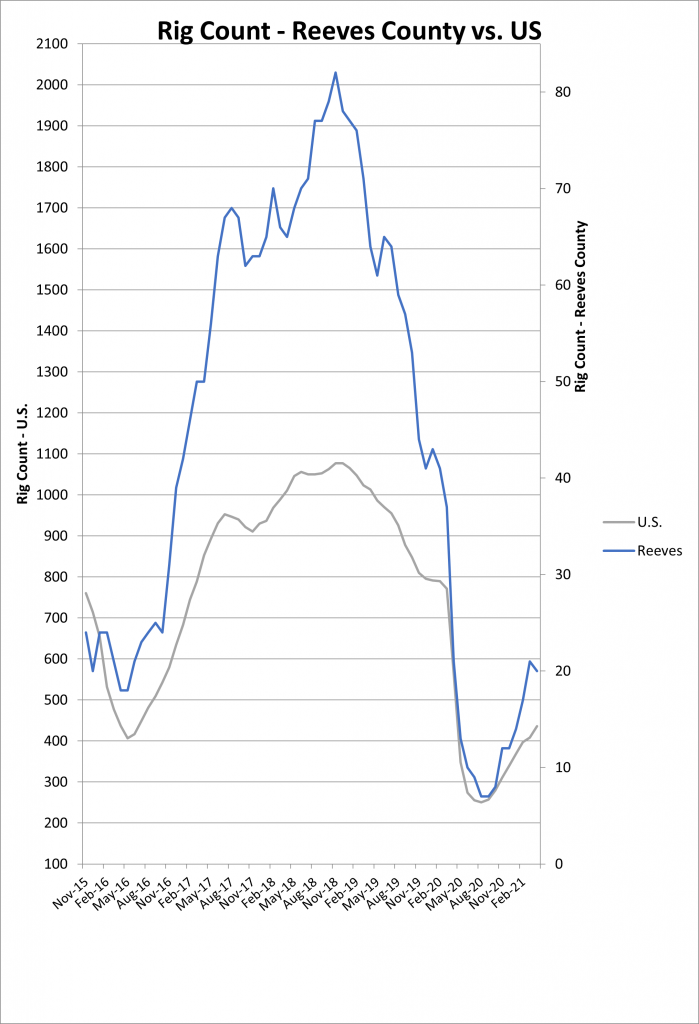

The upshot is that growth rates in US-based production are trending way slower than compared to previous recovery patterns. And, that is directly a cause of a slow recovery in rig counts shown in this graph:

This timid rebound – back to only 25% of the ’18 peak – is out of character with the usual trends. The explanation is the new financial discipline espoused by the most prominent shale players such as Pioneer Natural Resources, Occidental, Chevron, and BP, among others. Interestingly, the growth in rig counts that has occurred since last summer is disproportionately coming from upstart privately-funded E&Ps. Therefore, can they single-handedly destabilize the high prices attributable to the alliance’s cooperation? Here is a take on what that means from a respected observer:

Barclays analyst Jeannie Wai asks, “Could the privates ruin it for everyone?”

She’s not the only one asking. Coming off of year-end 2020 reports, public E&Ps dusted themselves off from the road grime of last year and offered their go-forward plans for the new journey that is 2021. Almost in unison they promised capital discipline well within internally generated cash flows and muted growth aspirations to mitigate any risk of oversupply as happened in recent years. Those sworn covenants were repentance to jilted investors and regardless of improvements in commodity pricing.

Private E&Ps, though, are not beholden to such promises. “The consensus view is that this group is less disciplined than their public peers as they are not subject to the same scrutiny/accountability by the market,” said Wai in an April research note. “Thus, the fear is that privates could accelerate production growth during the current goldilocks period of constructive oil prices and lower costs, despite oil prices being artificially supported by millions of barrels a day of production being temporarily held back from the market via OPEC+ curtailments.”

With WTI steady near $60/bbl, will privates ramp up rigs enough to tamp down prices? On the question of ramping up, Wai thinks the temptation for privates to take advantage of near-term cash flow while publics hold steady is too much to resist. “Thus we think the risk for private oil production is skewed to the upside.” Simmons Energy sell-side analyst Mark Lear concurs. In a March report, he said, “As we feel confident that the public E&Ps will maintain capital discipline to attract investors back to the sector, private E&Ps have undoubtedly become the ‘wildcard’ in the oil market.” Since April of last year, when the rig count reached historic lows, rigs from public E&Ps have increased by 61%, per Barclays. Privates are up 274%.

Private operators currently comprise 43% of the horizontal U.S. land rig count, compared to 29% a year ago, and accounted for one-third of overall U.S. tight oil production in 2020. Northland Capital Markets analyst Subash Chandra observed in a March research note that private operators such as DoublePoint Energy LLC and Mewbourne Oil Co. are running more rigs than Chevron Corp. and Exxon Mobil Corp. in the Permian Basin. “Private E&Ps could drive the rig count higher than we expected,” he alerted.

Private drillers were on pace to spend some $3 billion in the first quarter this year, he said, citing data from industry data provider Lium. Barclays postulated that while private operators are more price sensitive than their public peers, they are also not completely immune from the call for capital discipline from investors. Thus, the analysts estimated private companies would hold to an 85% reinvestment rate of capital going forward, much lower than their pre 2020 150% average rate. That is still more than the 60% reinvestment target the bank expects the publics to hold to. Based on that estimate, Barclays forecasts private operators could boost U.S. supply by about 500,000 bbl/d at 2021 exit. One caveat: If pent-up demand outpaces the bank’s projections, “prices could exceed our forecast and drive a stronger response from privates.

On the other hand, if the privates reinvest at a higher rate, there could be upside to our supply forecasts, all else being equal.” Simmons Energy ran a similar model and foresees private operators delivering some 5% to 7% onshore oil growth by year-end. Given the run in the forward oil curve yearto-date, much like their public counterparts, private E&Ps have the cash flow capacity to operate at significantly higher levels of activity, Simmons’ Lear said. However, “With a large number of bankruptcies in 2020, banks looking to reduce upstream lending exposure and reduced operating capacity, we would not expect private operators to rapidly get back to pre-pandemic operating levels, but wouldn’t be surprised to see the private rig count ultimately push toward 200 horizontal oil rigs.” Yet 200 privately deployed oil rigs is about the same as were running in 2019, and about 30 fewer on average than in 2018, according to Simmons’ data. So still a bit under par from recent years.

In March, the privates were running 120 oil rigs. But don’t fear private operators tanking world oil prices, said Lear. Not yet. “We concluded that privates alone would not be able to push U.S. onshore supply back toward pre-pandemic levels of 10.6 MMbbl/d by year-end 2022 and, as a result, don’t anticipate a U.S. supply response will have a negative impact on the duration of the recovery cycle.”

Privates, you are free to drill.

Steve Toon Oil and Gas Investor, Fri, 05/07/2021

The takeaway, according to Ms. Wai, is that the less-disciplined smaller private players are not impactful enough to move the needle in the Permian, and thus, the U.S. We shall see…

…In the meantime, back in the Delaware Basin, this slow recovery has implications for industrial land development in Pecos (Texas). For example, service companies considering a long-term decision such as whether to buy an industrial warehouse in Pecos are not close to ready to pull the trigger. The recovery looks too tentative to lease a Pecos warehouse, much less purchase land in Pecos. Hence, capital formation in the Delaware Basin region is substantially lagging even the rig count gains! Yet, very recent signals are indicating that there may now be a rekindling of interest in Pecos industrial land to lease.

Rig Counts Respond to Rapid Recovery in WTI!

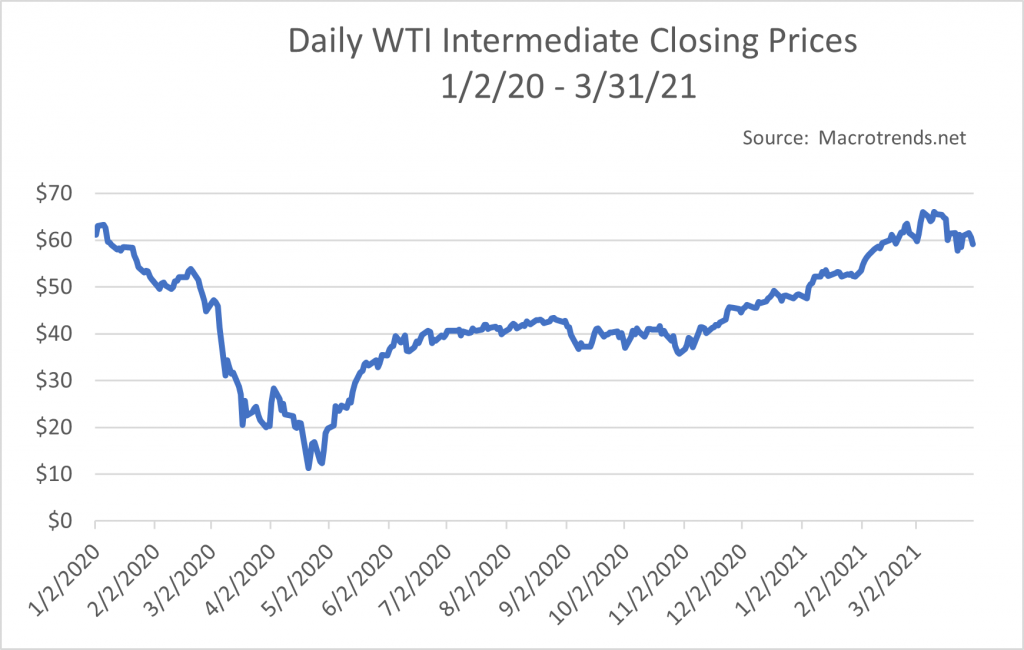

April 6, 2021 Article by Jeffrey PriceDefying all but the most optimistic forecasts, the US-based West Texas Intermediate prices have soared by 22% since ’20 closing price of $48.52.

This dramatic surge is attributed to optimism about an early wind-down of the pandemic-driven contractions and unexpected discipline on the parts of both OPEC+, and more surprisingly, the US shale industry centered here in the Permian.

Hence, growth rates in US-based production are way slower than compared to recent post-recession patterns. The upshot: Rig counts are up, but they have an awfully long way to go before they get near the frenzied levels of 2018 (and early 2019).

This lack of a fast rebound is said to reflect more “capital discipline” on the parts of producers and their suppliers.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region!

Where Are Oil Prices Going?

January 18, 2021 Article by Jeffrey PriceThat’s the $64,000 question! And, we don’t know the answer, but we know some smart people that have a pretty good grasp. Click below for two great insights into what to expect during this new year:

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region! Our industrial buildings (to rent or for sale) are state-of-the-art facilities for offices, shops, storage, and warehousing. We are Part of The Solution!

Do Rig Counts Tell Us Everything We Need to Know? – Part 3

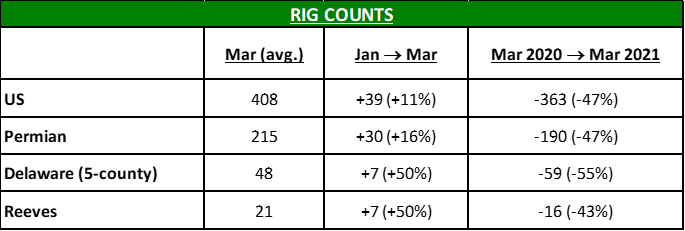

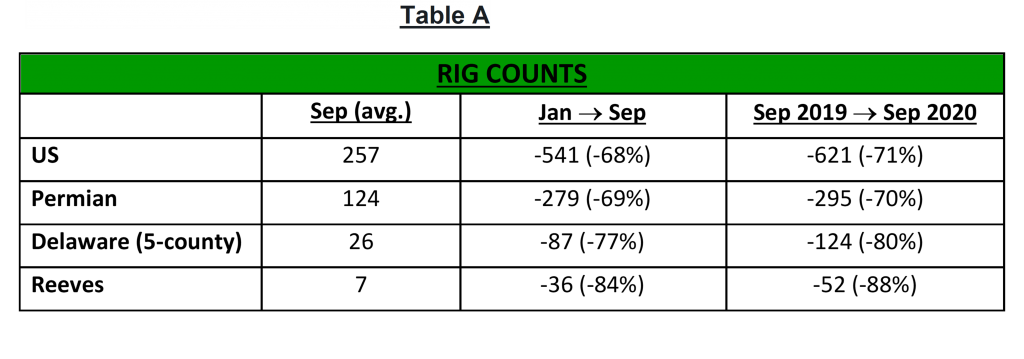

October 14, 2020 Article by Jeffrey PriceRig counts are a key statistic that indicates activity levels in the upstream oil & gas sector. And, we all know that it has plunged due to the unfortunate confluence of the O&G Recession and The Great Pandemic Recession. The following Table A lays out the severity of the rollbacks across the industry all the way through September. And, Reeves County and the Delaware Basin were not spared. In fact, they are down 88% year-over-year. Brutal!

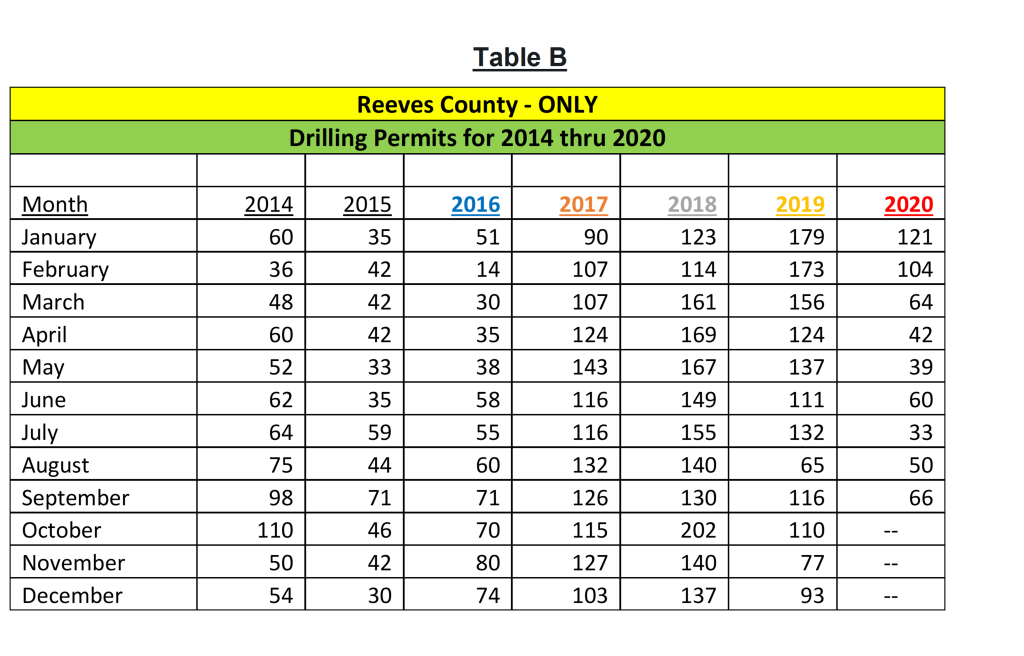

But the story is much more complex. For example, as shown in Table B, permits to drill wells, although down 50% from 2019, are still well in excess of 2016.

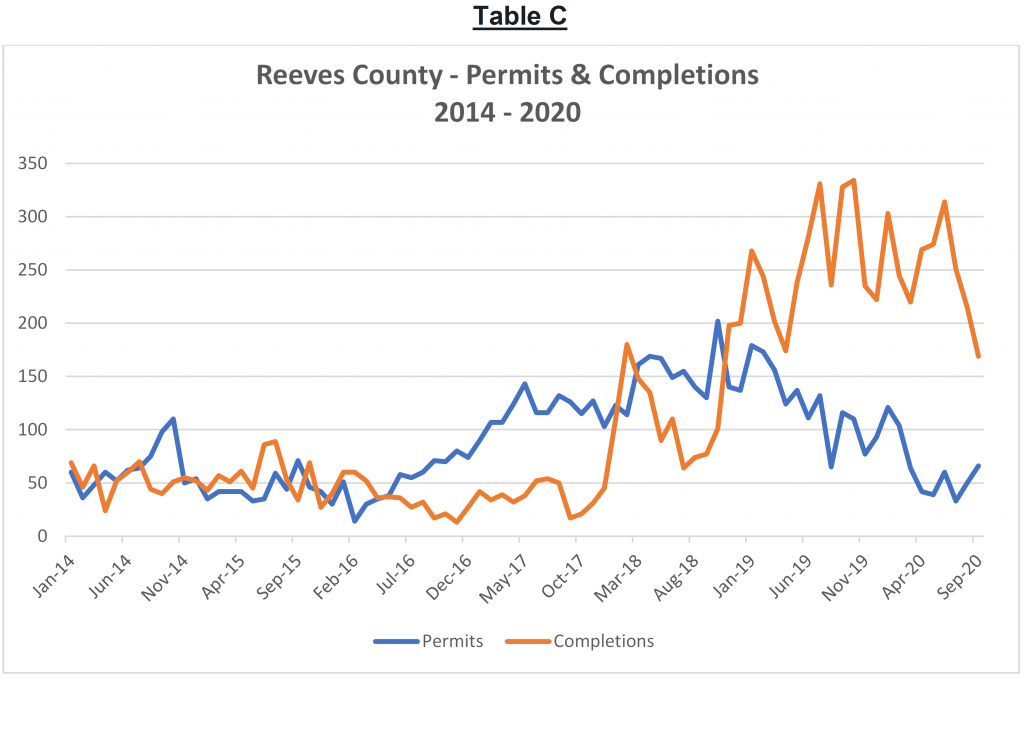

This ongoing level of activity is a positive sign that the commitment to the Reeves/Delaware Basin region is long-lasting. But very interestingly, completion activities are not off in the same proportions as drilling.

In fact, Table C (above) indicates that Reeves County’s completions (September) since January are “only” down by 44%. In fact, until only very recently, this activity has been within the range established in early 2019. Much better than the rig count! This is an indicator that oil companies are much busier than the low rig count signals.

Indeed, Chevron’s pending acquisition of Noble Energy, a leading driller in the Pecos/Delaware Basin Region portends a more aggressive approach to all aspects of “activity”: permits, drilling & completions.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region! We are Part of The Solution!