Do Rig Counts Tell Us Everything We Need to Know?

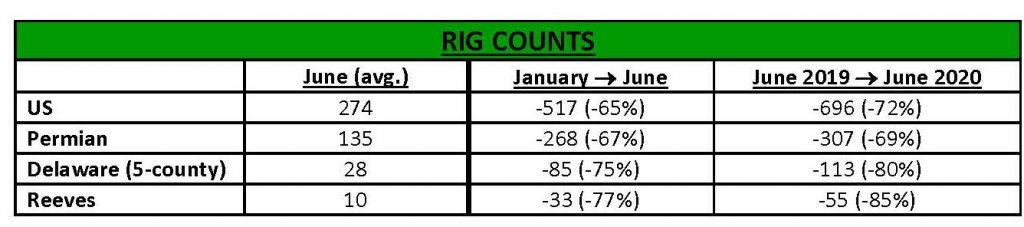

July 28, 2020 Article by Jeffrey PriceRig counts are key statistics to indicate activity levels in the upstream oil & gas sector. And, it has plunged thanks to the unfortunate confluence of the O&G Recession and the Great Pandemic Recession. The following Table lays out the severity of the rollbacks across the industry. And, Reeves County and the Delaware Basin were not spared.

As much as these statistics imply a race to zero, the story is much more complex. For example, permits to drill wells, although down 50% from 2019, are still well in excess of 2016. This is a sign that the commitment to the region is long-lasting. Ditto to the news of Chevron’s planned acquisition of Noble Energy, a leading driller in the Pecos/Delaware Region. Indeed, Noble, crippled by a heavy debt load, was like a wounded animal. And Chevron, large and financially muscular, was easily able to “devour” it. That means the new owner/developer of this world-class acreage will be able to be much more aggressive than the crippled predecessor.

“Bottom Line” is that permit levels are decent and Chevron’s takeover is a shot of adrenaline for the Pecos economy.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region!

What Do Rig Counts Tell Us?

December 27, 2019 Article by Jeffrey PriceAny seasoned professional involved in upstream oil & gas activities knows the importance of rig counts. Of course, the utility of this indicator has shifted over the years as the definition of a rig itself has undergone a metamorphosis; nevertheless, it remains a solid barometer that indicates levels of exploration and development.

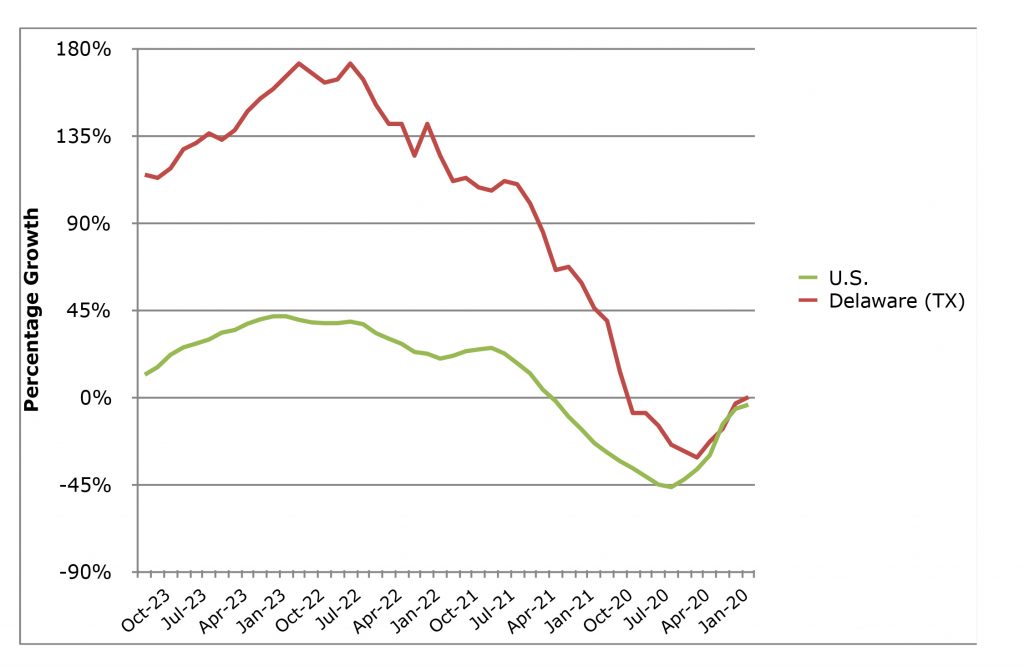

Certainly in the Delaware, rig counts correlated with the dramatic emergence of this province as being an elite sector for oil & gas growth in the US. The graph below charts the percentage gains since November 2015 of the Delaware versus the rest of the US. It shows that the Delaware doubled in this period, while the country is effectively flat.

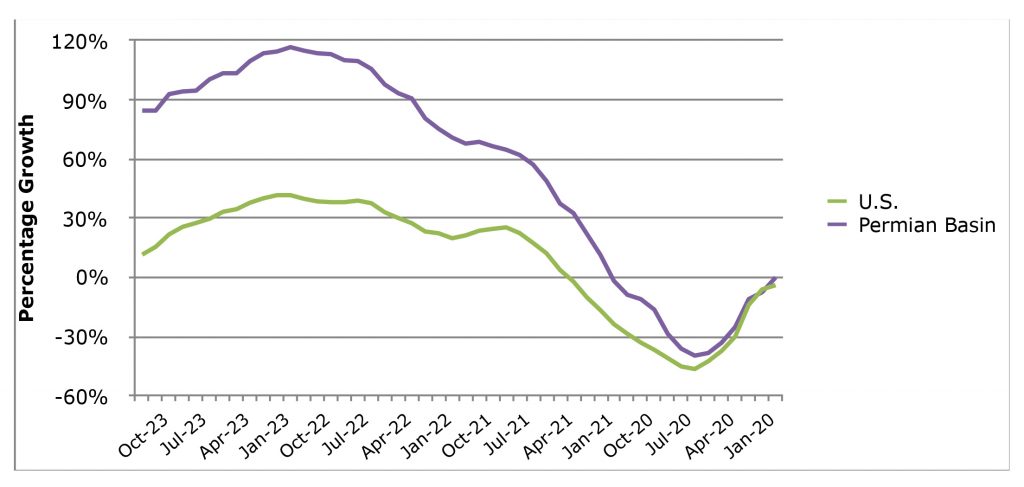

The Delaware is part of the famous Permian Basin. The Permian also outpaced the United States, but not at quite the same blitzkrieg rate. It is up “only” 80% in that time frame.

Interestingly, as the US itself has slowly peeled back by 21% since the beginning of 2019, the Delaware has also tracked it. The Delaware continues to surge in production even though its rig count is down by a more modest 15%. A key explanation is that the wells that are being completed are high-quality and the aggregate volume levels keep cumulating. This phenomenon does not persist in lower quality oil basins.

So, what’s going on? Stay tuned, we will have more to say in our March Report.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region! Our industrial buildings (to rent or for sale) are state-of-the-art energy efficient and we aim to keep America energy independent. We are Part of The Solution!

Jeffrey P. Price

First Keystone Pecos Industrial Park, L.P.

PO Box 2

709 Forest Grove Road

Wycombe, PA 18980

(215) 598-3000

(267) 278-0557 (Mobile)