Do Rig Counts Tell Us Everything We Need to Know? – Part 3

October 14, 2020

Article by Jeffrey Price

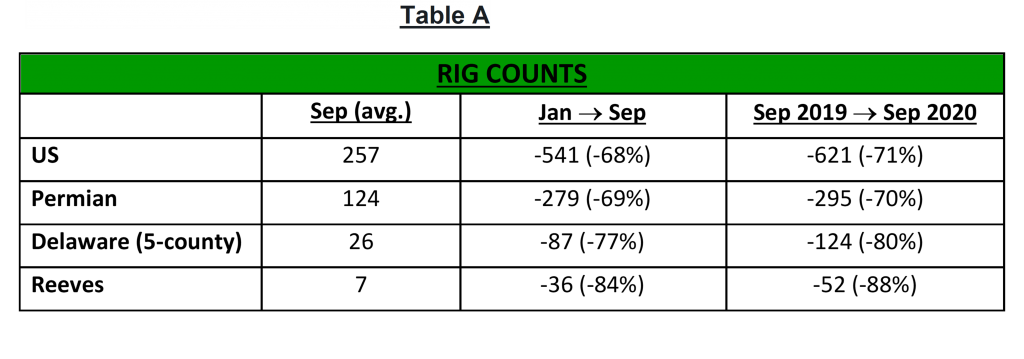

Rig counts are a key statistic that indicates activity levels in the upstream oil & gas sector. And, we all know that it has plunged due to the unfortunate confluence of the O&G Recession and The Great Pandemic Recession. The following Table A lays out the severity of the rollbacks across the industry all the way through September. And, Reeves County and the Delaware Basin were not spared. In fact, they are down 88% year-over-year. Brutal!

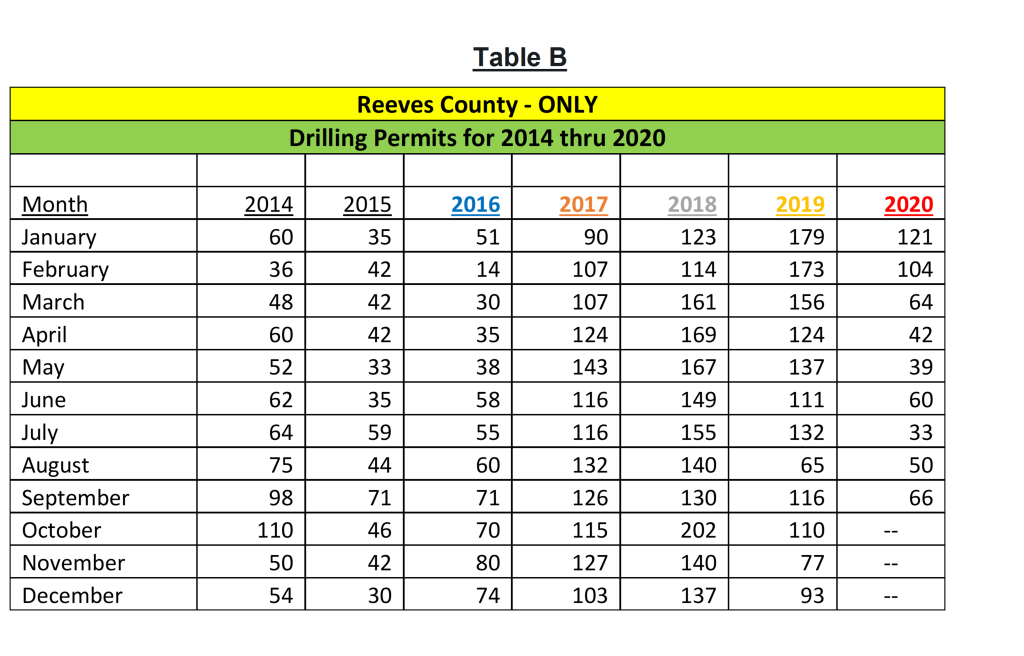

But the story is much more complex. For example, as shown in Table B, permits to drill wells, although down 50% from 2019, are still well in excess of 2016.

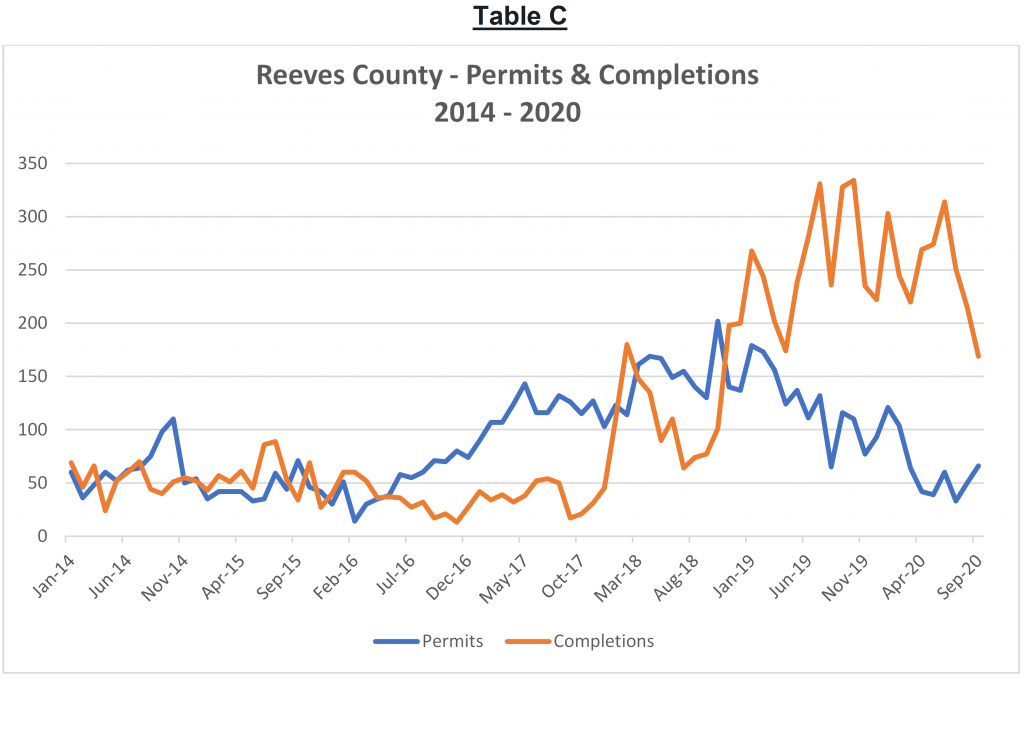

This ongoing level of activity is a positive sign that the commitment to the Reeves/Delaware Basin region is long-lasting. But very interestingly, completion activities are not off in the same proportions as drilling.

In fact, Table C (above) indicates that Reeves County’s completions (September) since January are “only” down by 44%. In fact, until only very recently, this activity has been within the range established in early 2019. Much better than the rig count! This is an indicator that oil companies are much busier than the low rig count signals.

Indeed, Chevron’s pending acquisition of Noble Energy, a leading driller in the Pecos/Delaware Basin Region portends a more aggressive approach to all aspects of “activity”: permits, drilling & completions.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region! We are Part of The Solution!