Do Rig Counts Tell Us Everything We Need to Know? – Part 4

July 26, 2021

Article by Jeffrey Price

The oil industry has a notorious reputation for booms and busts, and no two are alike. Obviously, the unprecedented collapse of drilling activity starting last March (’20) and ending in August was a chart-buster. However, the recovery that is currently underway displays its own unique facets. It is way slower than the rate of recovery in oil prices would imply. And, that’s affecting industrial leasing in Pecos, Texas in profound ways – but, there may be a long-term benefit from all this as reported in the article below from the Wall Street Journal of July 23, 2021:

Oil-field services companies have been in bunker mode for a while. They are finally starting to see some daylight.

After a cautious first quarter, industry giants Halliburton, Schlumberger and Baker Hughes all started chasing business more aggressively in the second quarter, with each seeing healthy sequential increases in revenue. It helps that they can now command better prices from producers able to haggle during downturns.

For several months already, oil prices have been well above pre-pandemic levels, but servicers’ revenues remain well below 2019 levels as producers opt to repair their balance sheets instead of chasing growth. Their bottom lines, however, are starting to show that their days spent scrimping and looking for efficiencies haven’t gone to waste.

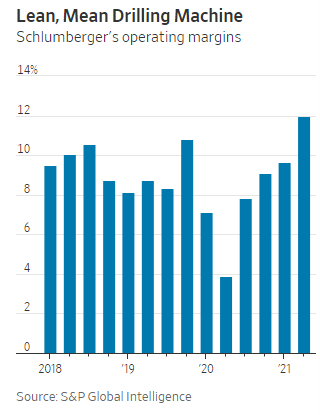

At Halliburton, revenue in the second quarter was less than two-thirds of what it was in the same period of 2019 but net income was three times as much. Operating margins at Schlumberger comfortably exceed pre-pandemic levels.

In another sign of progress, servicers’ free cash flows have started looking healthy enough that executives have begun fielding questions about when they might start returning excess cash.

Wall Street Journal

July 23, 2021

By Jinjoo Lee