Rig Counts Respond to Rapid Recovery in WTI!

April 6, 2021

Article by Jeffrey Price

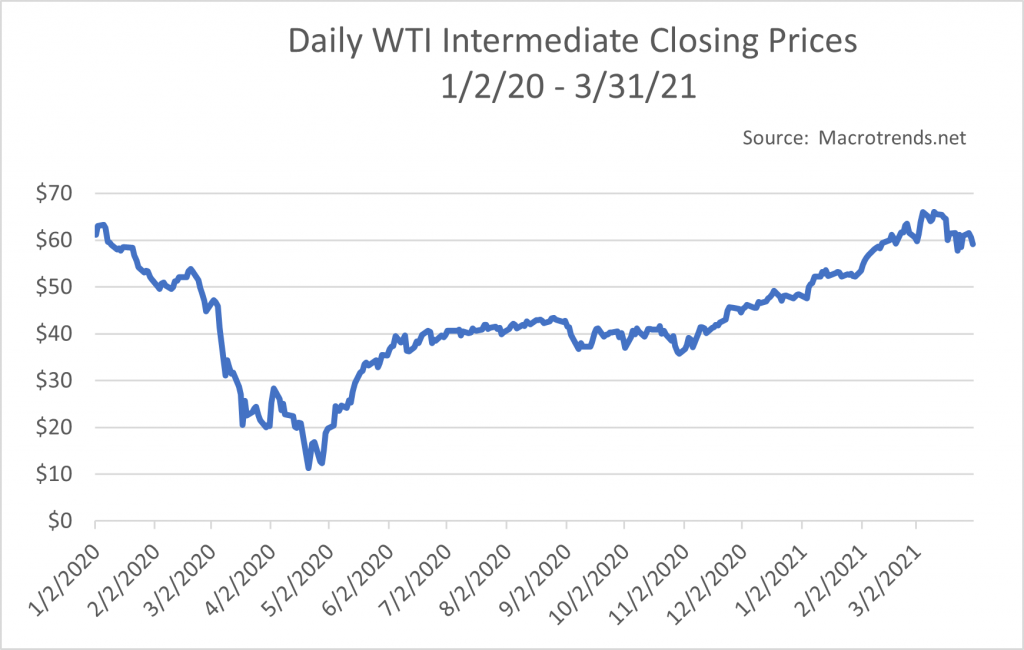

Defying all but the most optimistic forecasts, the US-based West Texas Intermediate prices have soared by 22% since ’20 closing price of $48.52.

This dramatic surge is attributed to optimism about an early wind-down of the pandemic-driven contractions and unexpected discipline on the parts of both OPEC+, and more surprisingly, the US shale industry centered here in the Permian.

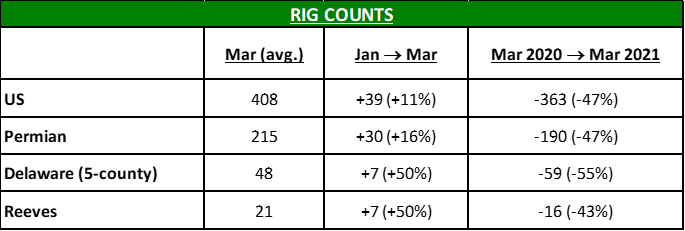

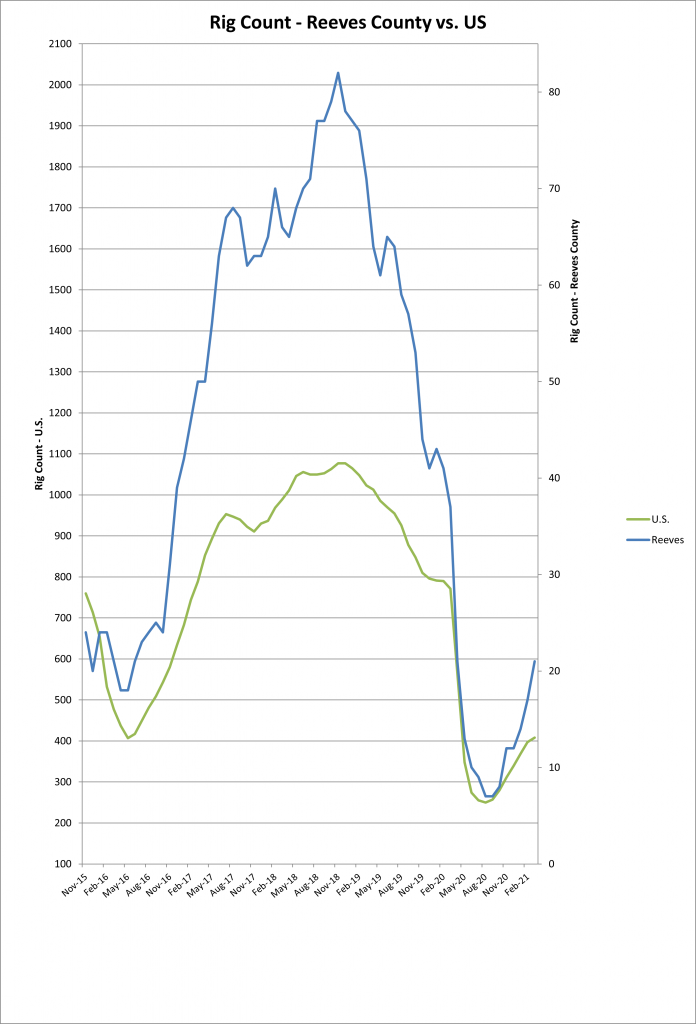

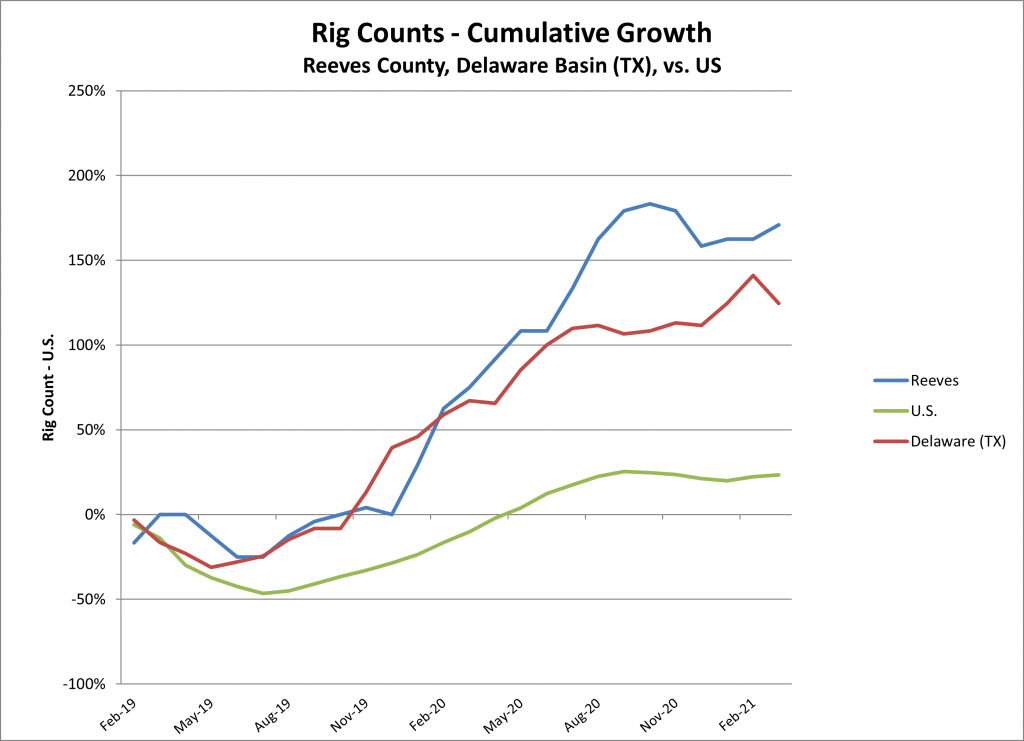

Hence, growth rates in US-based production are way slower than compared to recent post-recession patterns. The upshot: Rig counts are up, but they have an awfully long way to go before they get near the frenzied levels of 2018 (and early 2019).

This lack of a fast rebound is said to reflect more “capital discipline” on the parts of producers and their suppliers.

First Keystone is a supplier of state-of-the-art industrial warehouses for rent or purchase in the vital Pecos, Texas region!